Ultra Mega Power Projects: A Risk Analysis

Faculty Contributor: V. Ranganathan, Professor

Student Contributors: Arpit Agrawal, Ashish Chordia, Shovik Das, Neha Gupta, Gaurav Parasrampuria, Avinash Prakhya

Ultra mega power projects are 4000 MW power projects, which are an important component of the “Power for All” vision in the 11th plan. These projects face various risks in the nature of political, interest rate, construction, foreign exchange, fuel, transmission, payment and demand risks. This article looks into each of these and by analysing through various techniques, finds out which are more significant risks and hence require greater attention to mitigate.

Ultra mega power projects (UMPPs) were one of the first major steps taken by the Government of India in a bid to fulfill its ambitious aim of “Power for All” by the end of the 11th Plan. While 2012 seems a bit too near for this, some right steps in this direction have been taken. This article analyses one of such steps – the UMPPs – attempting to understand the risks involved with the projects and the various steps taken to mitigate the same.

UMPPs are 4000MW power projects which are to be set up in 14 locations1 as identified by the Government of India. Four of these have been awarded- the last being Tilaiyya UMPP awarded to Reliance Power in February of 20092. The project bids have so far been close, with the tariff having gone as low as Rs.1.1963. The large size of the UMPPs makes it all the more important that we analyse the risks that they face since a lot is at stake, both, in terms of the money involved as well as their strategic importance.

Political Risk

For UMPPs, apart from the sovereign risk, there is a specific state risk which the project companies are exposed to. Specifically, for the UMPPs, most of the clearances as well as the regulatory work like land acquisition is being done by the government. While this was done with the intention of expediting the process and making the project investor friendly governmental delays have inadvertently affected the projects and as such pose a political risk for the companies. Tilaiyya, the last UMPP to be awarded, faced such a problem resulting in its bidding process being delayed by almost 10 months4. Land acquisition is specifically a threat in the Naxal areas as it was for the Tilaiyya project.

In July last year, the then Power minister Sushil Kumar Shinde had to schedule meetings with the chief ministers of Chhattisgarh, Maharashtra, Orissa, Tamil Nadu and Karnataka - states where the projects had been stalled for reasons ranging from environmental concerns to differences with the state government.

Such instances significantly increase the political risk faced by the project company and at times also leads to withdrawal of interest from the investors during the bidding process.

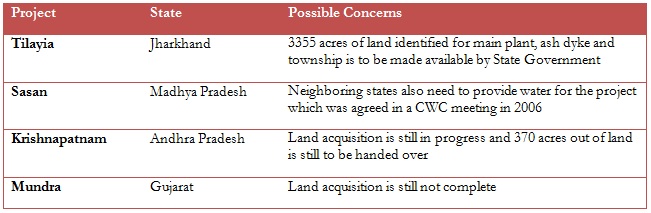

A brief overview of the possible concerns of few of the UMPPs awarded so far is outlined in Exhibit 1.

Exhibit 1: Political Risks associated with the UMPPs5

Exhibit 1: Political Risks associated with the UMPPs5

Interest Rate Risk

Debt is the primary source of financing in most infrastructure projects. The government, while conceptualizing the UMPPs, had a target debt-equity ratio of 70:30 in mind. It may be in the form of foreign currency or local currency. While rupee debt provides the advantage of eliminating the foreign exchange risk, companies find the rates to be much higher. In March 2009, for example, R-ADAG officials, trying to raise debt for Sasan and Krishnapatnam UMPPs observed that compared to the then prevailing LIBOR, a loan in the domestic market could potentially cost almost double.

However, foreign currency loans bring with them the inherent risk of foreign exchange. Moreover, LIBOR linked interest rates pose significant interest rate risk. In case of LIBOR bench-marked loans, there is a market for Interest rate swaps & currency swaps which can be used for the purpose of hedging the interest rate risk. Hence, a floating rate loan can be converted to a fixed rate loan through the use of derivatives. Since interest during construction (IDC) is very critical and impacts the overall cost of the project, the interest rate volatility can impact the fixed cost for the project as well as the interest costs during operation.

Construction Risk

UMPPs due to their inherent large installed capacity carry significant construction risks. We analysed all the UMPPs with respect to the possibility of delays. Delays may cause projects to lose their bankability due to increase in IDC and insufficient cash-flows or feasibility, due to increase in the quantum of debt required to service the delays. Moreover, if the unit is not commissioned by its Scheduled Commercial Operation Date, the project company, according to the power purchase agreement (PPA), would have to pay to each procurer liquidated damages thereby adding to its costs. To mitigate this risk, they have back to back contracts with their vendors/EPC contractors, effectively passing on the risk to them.

Since UMPPs are awarded through a competitive bidding route, they inherently have lower internal rate of returns (IRR). Therefore, any delays may cause the projects to become infeasible for the equity-holders. On analyzing the effect of delays on the UMPPs we found that all UMPPs have significant delay risks. In fact, the IRRs of most UMPPs, which are in the range of 10% to 12% (due to competitive bidding), dip to about 6-7% if the UMPPs are delayed by about 2 years6.

Thus we can say that all the UMPPs are highly susceptible to delay risks and a delay of even a few months is likely to hurt the returns from the projects. Hence, the developers must do everything possible to make sure that the projects are commissioned on time.

Foreign Exchange Risk

All the UMPPs differ significantly in their dollar denominated debts. Since, not much secondary information is available on whether the exchange rate risk is borne by the developer or by the off-taker, we assume that the entire risk is borne by the developer for the purpose of our analysis.

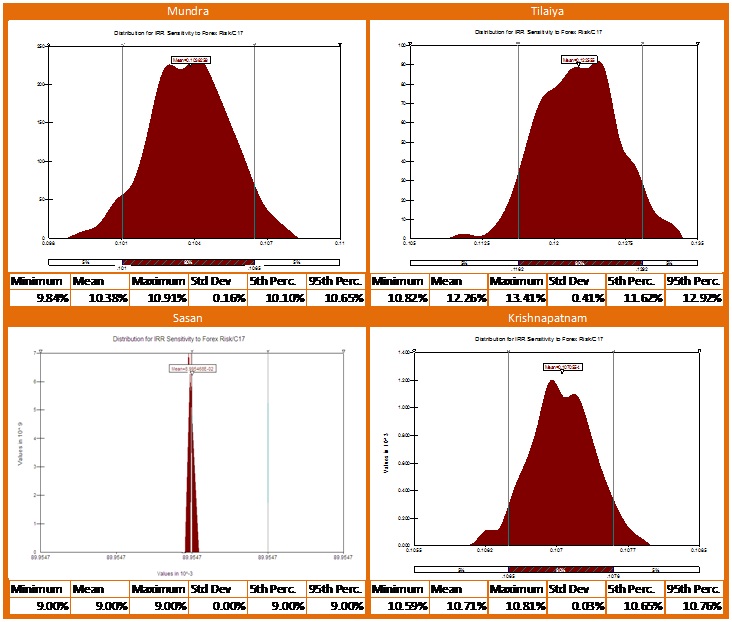

For finding out the IRR sensitivity to foreign exchange rates for each of the UMPPs, the @Risk add-on for Excel was used for simulation. We noted the dollar denominated debt and varied it in the approximate range of Rs.40/USD – Rs.50/USD. The variations for every year were independent of each other. Assuming a normal distribution, a comparison of the foreign exchange risks for different UMPPs was carried out and the results are as displayed in Exhibit 2.

Exhibit 2: Comparison of the Foreign Exchange Risk for different UMPPs

Exhibit 2: Comparison of the Foreign Exchange Risk for different UMPPs

Thus we find that Sasan is most protected against foreign exchange risk since it is funded entirely by rupee debt. As a result, there is no variability in the IRR figures for Sasan. For some, such as Mundra, the variation is marginal due to little dollar denominated debt.

In all cases however, we see that the foreign exchange risk faced by the developers is minimal.

Fuel Risk

The low calorific value, high silica content and ash content of Indian coals could increase the capital expenditure (the boilers are larger using more advanced materials) and operating expenditure (other operations and maintenance costs higher as the plant is bigger) in India beyond the levels seen internationally. This risk may be mitigated by washing or using ultra supercritical technology with international coals in coastal sites.

There is an additional risk of security of supply of imported coal required for the coastal UMPPs. The supply security is difficult to guarantee especially if being imported from politically unstable countries. There is a foreign exchange risk associated with imported coal required for the coastal UMPPs. The project company can hedge the foreign exchange risk either by engaging in long-term coal purchase contract, and/or indigenizing fuel costs by acquiring foreign coal mines.

Transmission Risk

In India, there is a lack of sophistication of transmission and distribution network as India does not have a state-of-the-art, nation-wide transmission grid. The state of the power plants running at lower capacity utilization can adversely impact the profitability of the proposed project activity and also reduce the lifetime of the power plant equipments. This risk can be mitigated by investment in transmission and distribution network. If the existing 400KV transmission lines are not adequate, the feasibility of higher voltage lines needs to be worked out.

Payment Risk7

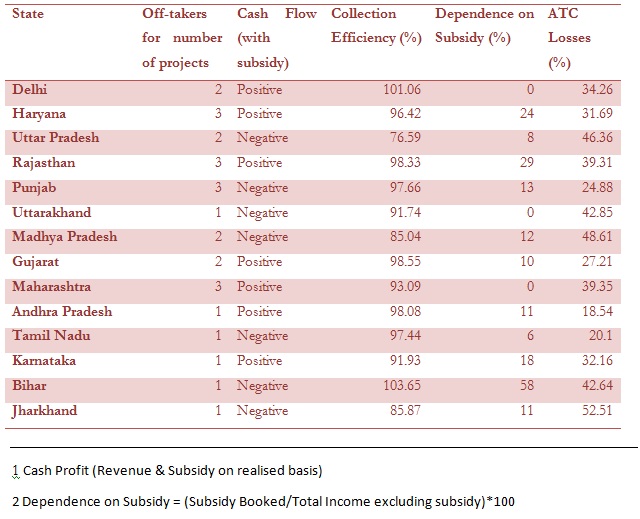

The off-take agreements have been signed by the producers with primarily the state electricity boards(SEB) and they do not have a very good payment record. Thus payment and default risk are big concerns for the lenders. We see that all state utilities are suffering from aggregate technical and commercial (AT&C) losses and half of these states are cash flow negative even after the subsidy is given. The SEB performance8 in 2006-07 has been shown in Exhibit 3.

Exhibit 3: SEB Performance for 2006-07

Exhibit 3: SEB Performance for 2006-07

For mitigating the same, provisions for Letter of Credit backed by a credible escrow deposit mechanism have been included in the PPA. Each procurer needs to provide to the seller, an unconditional, revolving and irrevocable letter of credit. Each procurer shall also open a default escrow account in favour of the seller, through which the revenues of the relevant procurer may be routed. In addition, clauses have also been introduced for the escape routes for the project company in the event of default by the procurers: failure to realize payment within 7 days of the due date shall entitle the seller to sell up to 25% of the contracted power to other parties without losing claim on the capacity charges due from the procurer. In case the collateral agreement is not restored within 30 days of the due date of the invoice, the project company can sell upto 100% of the contracted capacity.

Even then payment risk is not fully mitigated, for there can be a situation where existing buyer does not pay and there are no new buyers. Escrow mechanisms act like a powerful pain reliever; they may mitigate the short term pain but does not contribute to the long term health of the buyer of electricity.

Demand Risk

The purchaser pays fixed capacity charges to the project company to reflect the fixed costs and profit elements of the project. A separate energy charge is also paid for each unit of electricity generated, to cover the variable costs such as fuel. The reason behind for the above mechanism is that project needs to cover its costs irrespective of whether the power purchaser actually uses the electricity. Take or pay contract specifies that in the event, the project’s output is not taken, payment must be made whether or not the output is deliverable.

In the event that he does not avail of power upto the contacted available capacity, the seller has the right to sell the power not procured to any person without losing the right to receive the entire capacity charge from the concerned procurer. Thus, the two part tariff mechanism takes care of demand risk.

Conclusion

The power crisis in India is getting bigger day by day and the government needs to come up with concrete plans for power generation. Construction of UMPPs was the biggest step towards this aim and it needs to carefully given a thought before construction, to minimize the troubles it faces. Looking at the overall risk portfolio for a UMPP, we see that while some like foreign exchange risk for debt do not pose a big threat, others like payment risk have been mitigated through appropriate clauses in the PPAs. Yet, others like fuel risk and political risk persist. Given the critical role these projects might play in the future of this country, it is important to understand the risk factors associated with these projects in depth and mitigate them through changes in the underlying contracts and the process adopted for power generation.

Keywords

Ultra Mega Power Projects, Risk analysis, Power Projects, Risks of power projects

Contributors

Prof V. Ranganathan is the Reserve Bank of India Chair Professor of Infrastructure in the Economics and Social Sciences Area in IIM Bangalore. He is a Fulbright scholar from the Kennedy School of Government in Harvard University. He holds an FPM from IIM Ahmedabad, India. He can be reached at ranga@iimb.ernet.in.

Arpit Agrawal (PGP 2008-10) holds a B Tech degree from National Institute of Technology Allahabad and can be reached at arpit.agrawal08@iimb.ernet.in.

Ashish Chordia (PGP 2008-10) holds a B Tech degree from Indian Institute of Technology Kharagpur and can be reached at ashish.chordia08@iimb.ernet.in.

Shovik Das (PGP 2008-10) holds a B E degree from Jadavpur University and can be reached at shovik.das08@iimb.ernet.in.

Neha Gupta (PGP 2008-10) holds a B.A. (Hons.) Economics degree from Delhi University and can be reached at neha.gupta08@iimb.ernet.in.

Gaurav Parasrampuria (PGP 2008-10) is a qualified Chartered Accountant & Company Secretary and can be reached at gaurav.parasrampuria08@iimb.ernet.in.

Avinash Prakhya (PGP 2008-10) holds a M.Tech & B.Tech degree from Indian Institute of Technology Roorkee and can be reached at avinash.prakhya08@iimb.ernet.in.

References

- The Business Standard, “RFQ for atleast one UMPP expected soon”, http://www.business-standard.com/india/news/rfq-for-at-least-one-umpp-soon-officials/363634/, Last accessed: 3rd Aug ‘09

- The Financial Express, “Reliance Power bags 4000MW Tilaiya UMPP, http://www.financialexpress.com/news/reliance-power-bags-4-000-mw-tilaiya-umpp/416306/, Last accessed: 24th July ‘09

- Ibid.

- The Hindu, “Reliance Power bags Tilaiya mega project in Jharkhand”, http://www.thehindu.com/2009/01/29/stories/2009012956311600.htm, Last accessed: 24th July ‘09

- Compiled from Infraline Energy, www.infraline.com, Last accessed: 10th Aug ‘09

- Models recreated based on data from Infraline Energy, http://www.infraline.com/powersector/default.aspx?URL1=/power/stats/generation/UMPP.aspx&idCategory=2580, Last accessed: 19th Aug ‘09

- Power Finance Corporation “Power Purchase Agreement” http://www.pfcindia.com/Mundra%20PPA%20210806.pdf, Last accessed: 7th Aug ‘09

- Power Finance Corporation Ltd, “Report on the Performance of State Power Utilities for the Years 2004-05 to 2006-07”, Ministry of Power (India)