The Real Climate Debate: To Cap or To Tax?

Faculty Contributor: Sankarshan Basu, Associate Professor

Student Contributors: Abhishek Bansal and Manu Jain

Two systems that have been implemented to ensure a lowering in the greenhouse gas emissions are the carbon tax system and the cap-and-trade system. This article looks at both these systems in order to find the better system. The carbon tax has been a failure in most cases where it has been implemented. On the other hand the cap-and-trade system is difficult to implement.

Rapid industrialization over the past couple of centuries has led to an increased amount of greenhouse gas (GHG) emissions. The average temperature of the earth's surface has risen by 0.74° Celsius since the late 1800s. It is further expected to increase by another 1.8° C to 4° C by the end of this century – a potentially destructive phenomenon. A major component of this temperature increase is attributed to the GHG emissions. This article discusses two broad mechanisms to check GHG emissions, namely the carbon tax and the cap-and-trade system. It also develops a relationship between carbon, coal and natural gas prices, and is therefore able to predict prices of carbon credits.

The Context: UNFCCC & Kyoto Protocol

An international treaty, the United Nations Framework Convention on Climate Change (UNFCCC), aimed at stabilizing greenhouse gas concentrations in the atmosphere, was formed in 1992. Later, an addition to the treaty, the Kyoto Protocol, which sets binding targets for 37 industrialized countries and the European community for reducing GHG emissions, was approved. Kyoto includes defined "flexible mechanisms" such as Emissions Trading, the Clean Development Mechanism and Joint Implementation which allow Annex I nations (developed nations like Japan and Australia) to meet their GHG emission limitations. This is done by purchasing emission reductions credits, through financial exchanges, from projects that reduce emissions in non-Annex I economies (developing nations like China and India), or in other Annex I countries.

Another by-product of the Kyoto Protocol is carbon credits, which are part of a tradable permit scheme. They provide a way to reduce greenhouse gas emissions by giving them a monetary value. A credit gives the purchaser the right to emit one tonne of carbon dioxide (CO2) or its equivalent. The seller is typically someone who is not using his prescribed GHG emission limits to the full extent, and thus this provides an incentive for more entities to engage in carbon-neutral or low-carbon activities.

GHG Abatement Techniques

There are two broad mechanisms to mitigate GHG emissions viz. the carbon tax and the cap-and-trade model. Most of the policy discussion has focused on cap-and-trade systems, but carbon taxes have been applied in northern Europe since the early 1990s.

- Carbon Tax System: GHG emissions are negative externalities, because they have a negative effect on a party not directly involved in the transaction. It is proposed that fossil fuels, which are the source of negative externality, be taxed so as to accurately reflect the cost of the goods' to society. This internalizes the costs associated with the goods' production. Countries such as Finland, Great Britain and New Zealand have implemented this model.

- Cap-and-Trade System: In this system, a central authority sets a cap on the amount of a pollutant that can be emitted by each company. Companies that need to increase their emissions must buy credits from those who pollute less, creating a trade of credits. Thus, the buyer pays a charge for polluting, while the seller is rewarded for reducing emissions by more than was needed.

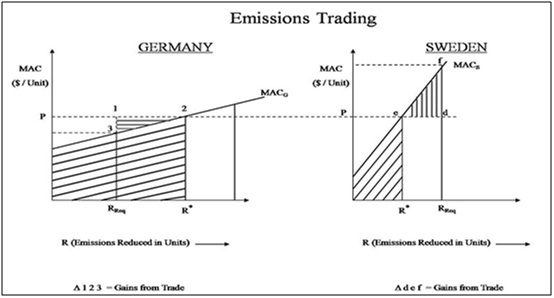

Exhibit 1: Mechanism of Emission Trading (Cap-and-Trade Model)

Exhibit 1: Mechanism of Emission Trading (Cap-and-Trade Model)

Exhibit 1 depicts the cap-and-trade mechanism between two countries. For Germany, the marginal abatement cost (MAC) is low; and hence it has R* - RReq excess credits (it reduces more emissions). On the other hand, Sweden has higher MAC, and falls short by R* - RReq credits. By buying credits from Germany at a price P, Sweden is able to save money equal to triangle def and similarly Germany is able to make a profit depicted by triangle 123.

The differences between the Carbon Tax and Cap-and-Trade Model are analysed next.

Distinctions between Carbon Tax and the Cap-and-Trade Model

The two models differ on various aspects as discussed below.

- Fixed Abatement Cost vs. Fixed Allowance: Carbon tax imposes a fixed abatement cost on the emitters. This is of significant disadvantage to industries where switching costs are high. On the other hand, the cap-and-trade system helps in reducing the marginal abatement costs of the company, as they can easily buy credits from companies that find it easier to reduce GHG emissions.

- Redistribution Effect: Both systems increase the cost of essential goods like natural gas, coal and electricity for people. But since carbon tax is collected by the government, it can redistribute the fiscal benefits obtained by lowering the income tax on lower income people. Such redistribution effects are difficult to achieve using a cap-and-trade system.

- No allowance in Tax System: The quota (cap) system is based on the belief that marginal cost (MC) arises only if emitters increase their emissions beyond a level. On the other hand, a tax based system imposes a charge (MC) on every ton of CO2 emitted starting from the very first emission. This is the reason why the tax approach is blamed for aggravating the MC for the economy.

- Efficient techniques to reduce GHG emissions: Unless fiscal benefits from carbon tax are used to develop technology to tap renewal energy or other mechanisms to reduce GHG emissions; carbon tax does little other than increasing the general price level. On the contrary, the cap system necessarily reduces emissions due to the inherent cap and trading helps in the discovery of cheap and efficient ways to reduce emissions.

- Predictability to Energy Prices: The tax based approach gives firms time to respond to increased fuel prices, but the price shocks in the market may not give adequate time to firms to respond. So, in the long run, a tax-based system can help firms to migrate towards efficient use of fossil fuels. The cap-and-trade market is usually very volatile. But in the long run, the market helps in achieving the same effect. To counter the price shocks at times, a price ceiling is imposed on carbon prices.

- Speed of implementation and cost of administration: Carbon taxes can be implemented much sooner than complex cap-and-trade systems. Significant administrative oversight will be required to track emissions, ensure permit compliance, and monitor trading in a cap-and-trade system.

- Reward for reducing emissions: The tax system doesn’t incentivize people to do activities that reduce impact of GHG emissions like planting trees, use of renewable energy, etc. The cap-and-trade system rewards such projects based on how much more GHG would have been emitted had the project not been implemented.

Some examples of attempts by countries to curb GHG emission are presented below.

Case: Carbon Tax in Norway and Denmark

Norway enacted a tax on carbon emissions1 in 1990s but it did not lead to large decline in emissions. In fact emissions actually increased by 43% per capita! The story is similar in Finland. The governments in these countries were more concerned about internalizing the environmental costs than reducing emissions.

The only notable success story of carbon tax has been in the case of Denmark2. Per capita emissions in 2005 were lower than the 1990s figure by nearly 15%. The reason it worked in Denmark is because the tax proceeds were used to provide subsidies for the use of environmental friendly methods. But in most countries, carbon taxes are redistributed in the form of income tax benefits to households, thus helping the ruling party to get political mileage.

Case: Sulfur Allowance Trading Program (SAT) in the US3

SAT, which regulates and caps only one pollutant, i.e. sulfur dioxide (SO2) has features relevant to cap-and-trade model. The permits are freely allocated based on fixed emissions rates established by law and by historic fossil fuel use. Trading is permitted and fines are levied on plants that exceed the emissions allowed by the permits held through allocation or trading.

In spite of a few differences with the GHG emissions program like:

- SO2 trading program addresses only power plants; ideally, a GHG emissions program would address all sectors of the economy;

- It may be preferable to regulate “upstream”, which means regulating producers or processors of GHG-related commodities, such as coal, rather than directly regulating emitters,

SAT is widely considered to be a success. Not only have emissions been reduced to the targeted levels, but the actual cost of reductions has been only half of what was expected when the program was enacted.

Conclusion

The initial adaptation of the cap-and-trade system is difficult as it involves lot of administrative overheads, expenses in carefully monitoring emissions, legislating proper laws, and legally formulating penalties against the defaulters. But once implemented, it offers a much more cost effective way to lower carbon emissions. The success of the Sulfur Allowance Trading Protocol is a testimony in this regard. The implementation of carbon tax has failed in 9 out of the 10 cases due to political interests of the governments. Hence, it is believed that to lower GHG emissions, the cap-and-trade system shall prove to be the most effective mechanism.

Contributors

Sankarshan Basu is an Associate Professor in the Finance and Control Area at IIM Bangalore. He holds a Ph.D. in Statistics from London School of Economics and Political Science and M.Sc. in Statistics from Indian Institute of Technology (IIT) Kanpur. He can be reached at sankarshanb@iimb.ernet.in.

Abhishek Bansal is a second year PGP student at IIM Bangalore. He holds a B. Tech. in Electrical Engineering from Indian Institute of Technology (IIT) Roorkee. He can be reached at abhishekb07@iimb.ernet.in.

Manu Jain is a second year PGP student at IIM Bangalore. He holds a B. Tech. in Computer Science Engineering from Indian Institute of Technology (IIT) Roorkee. He can be reached at manuj07@iimb.ernet.in.

References

- Aldy Joseph E, Ley Eduardo, Parry Ian W. H A Tax based approach to Global Climate Change; Resources for the future

- Johansson, Bengt. (2000). “Economic Instruments in Practice 1: Carbon Tax in Sweden; .” Swedish Environmental Protection Agency. http://www.oecd.org/dataoecd/25/0/2108273.pdf . Last accessed on March 12th 2010.

- Kruger, Joseph (2005), From SO2 to Greenhouse Gases: Trends and Events Shaping Future