Consumers' and Retailers' Perspective on Private Labels in Indian Apparel Retail

Faculty Contributor : Nagasimha Balakrishna Kanagal, Associate Professor

Student Contributors : Jyoti and Sangeeta Patel

The Indian apparel industry in retail is growing rapidly, with an increasing focus on private labels (PLBs). Recently, in a sharp contrast to earlier periods, consumers have started considering purchase of PLBs as smart shopping. Considering these aspects, this article aims to analyze the association of PLBs with customers and retailers so as to gauge customer loyalty, consumer preferences, shopping behaviour and also to understand the marketing strategies and objectives of PLB retailers. It provides an insight into the positioning of brands and PLBs in the minds of consumers and recommends suitable strategies to enhance the market share of private labels.

Indian retail industry is the fifth largest in the world, with a size of $353bn and is growing at 12% per annum1. If we talk about the apparel sector, it is the second largest segment in terms of its contribution to the retail market. The overall size of the textile and apparel industry in India is currently estimated at $70bn and is expected to grow to $220bn by 2020 with a CAGR of 11%. Currently, menswear is the biggest segment of the domestic apparel market with 43% share of the total pie while women’s wear constitutes 38%2. As per the recent trends, there has been an increasing focus on private labels. Private labels constitute around 21% of total sales in the Indian apparel sector.

The major elements of the PLBs are rational and emotional appeal. Rational appeal includes the marketing mix and distinct positioning, while emotional appeal involves communication with customers. The consumer’s perception behind buying PLBs depends on demographic factors, individual difference variables like extrinsic cues, level of perceived risk and degree of knowledge about a particular category. Besides higher margins, the key growth drivers for PLB retailers are differentiation and positioning in economic downturns, freedom with pricing strategy and strong customer loyalty. Private labels provide the retailer the ability to offer a significant price advantage to consumers, typically around 16-32% lower as compared to manufacturer brands.

Empirical Studies on Consumers and Retailers Perception3

In order to understand the perception of consumers and retailers in the apparel segment, primary and secondary methods were employed. Focus group discussions and in-depth interviews with consumers show that the major factors behind purchase of PLBs are demographic factors, degree of consumer knowledge, perceived value for money, level of risk and variety-seeking behaviour.

On the other hand, retailers have a very strong inclination towards the development and growth of PLBs because of the benefits that they seek in terms of profitability, enhancement of store image and long term plans of securing their market share. Coming to the objectives of retailers behind launching private labels, they employ certain marketing strategies like customer feedback, in-house promotions, customer service, market research and store ambience for driving the growth of PLBs.

I. Consumer Survey Analysis

To validate our findings from the focus-group discussion and in-depth interviews, we conducted a customer survey. Considering that demographic factors play an important role in driving the consumer’s perception, we took up age, income and gender for segmentation of the respondents. The inputs were taken from a representative sample (50% male, 50% female; 50% in the age of 15-24 years, rest above 24 years; 50% in the income category of 6 -12 lakhs, rest above 12 lakhs) in the form of a questionnaire. The data collection focused on the western wear category for women and formal dress shirts for men. Quantitative tools like factor analysis, multi-dimensional scaling (MDS) and snake diagrams helped in analysing the primary data. The results of each of these analyses are presented below.

a. Factors that Influence the Purchase of a Brand, PLB and Apparel by Consumers

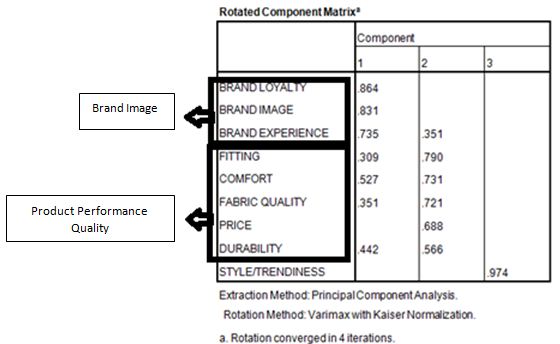

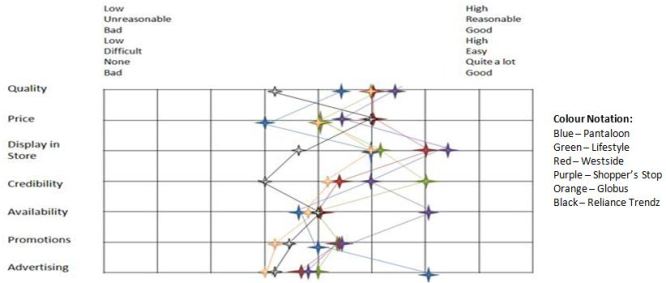

We have used factor analysis for finding the major factors that influence purchase of a brand, PLB and apparel by consumers. Exhibits 1 and 2 show the rotated component matrix for different analyses. It contains the coefficients used to express the standardized variables in terms of the factors. A high value indicates that the factor and the variable are closely related. In exhibit 1, we can see that the first three variables in the first column have high loadings for factor 1. Next five variables are closer to factor 2. Style or Trendiness is the only variable that has loading for factor 3. On the basis of the analysis of rotated component matrix, we can say that first three can be labeled as a Brand image factor while next five can be labeled as Product performance quality. Similar analysis has been done for PLB and Apparel. The major factors that influence the purchase of a brand by consumers can be categorized broadly into two dimensions - Brand Image and Product Performance Quality (Exhibit 1).

Exhibit 1 Factors influencing the purchase of a Brand

Exhibit 1 Factors influencing the purchase of a Brand

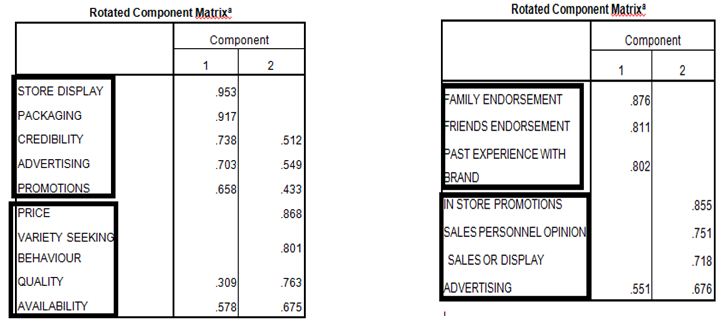

On the other hand, the purchase of PLB is influenced by Product Presentation and Product Performance dimensions (Exhibit 2). When the entire apparel category was considered, the two major dimensions came out to be Reputation and Marketing Effort.

Exhibit 2 Factors influencing purchase of PLB and Apparel

Exhibit 2 Factors influencing purchase of PLB and Apparel

b. Consumer’s Perception of In-house Brands versus Established Brands

To get a comparative view of the differences in perception towards in-house brands and established brands, a perceptual map plotted using MDS gives us insights into their distinct positioning in the consumer’s mind (Exhibit 3). The dimensions used for analysis were marketing effort and reputation.

Exhibit 3 Perceptual Map of Brands and Private Labels

Exhibit 3 Perceptual Map of Brands and Private Labels

For western wear for women, Lifestyle is perceived quite high on marketing efforts whereas for the other dimension, reputation, Adidas scores far better than Levis. In the case of shirts for men, John Miller has better marketing efforts whereas Allen Solly ranks high on reputation. The major inferences in both categories, i.e. shirts for men and casual western wear for women, is that PLBs rank high on marketing effort dimensions while brands score high on reputation.

This is also a major insight from the focus group discussions with consumers. PLBs are owned by retailers because of which they have certain limitations in terms of their availability. Therefore to gain margins on them, retailers have to take certain major steps in terms of marketing efforts such as in-house promotions, advertising and proper positioning to attract consumers to their retail stores.

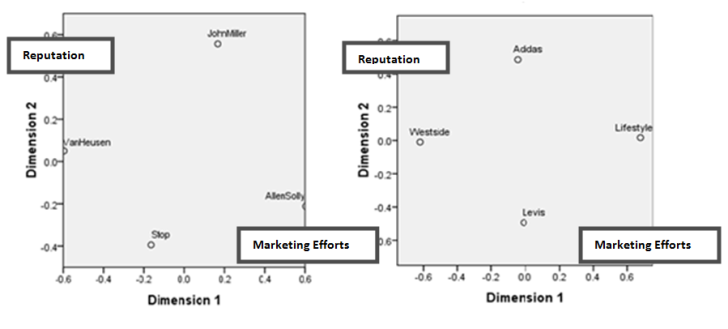

c. Comparison across PLB Retail Chains

A comparative view of different PLB retail chains can be understood through a snake diagram. The six retailers (Colour Code – Pantaloons (Blue), Westside (Red), Shoppers Stop (Purple), Reliance Trendz (Black), Lifestyle (Green) and Globus (Orange)) were compared on certain vital parameters such as price, quality, availability, and display in store, credibility, promotions and advertising on the basis of consumers rating (Exhibit 4). Shoppers Stop outperformed while Reliance Trendz painted a sorry picture on a majority of parameters.

Exhibit 4 Snake Diagram for PLB Retail Chains

Exhibit 4 Snake Diagram for PLB Retail Chains

II. Retailer Survey Analysis

For primary research, a survey was conducted with the sample size of 6 PLB retailers in the city of Bangalore. The sample set includes Westside, Lifestyle, Pantaloons, Shoppers Stop, Reliance Trendz and Vishal Mega Mart. The results are as follows:

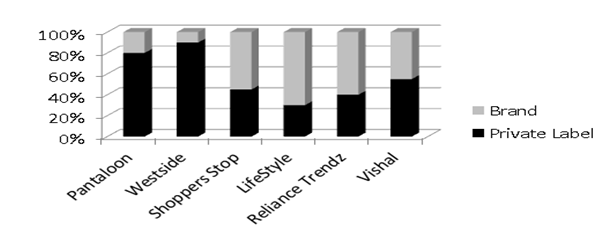

a. Store Composition

Among the 6 retailers, Westside has the highest percentage of in-house brands in its outlets whereas Lifestyle ranks the lowest (Exhibit 5).

Exhibit 5 Store Composition

Exhibit 5 Store Composition

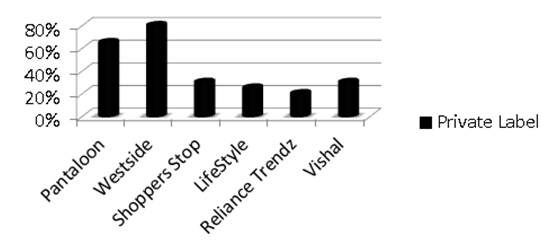

b. Sales of PLB as Percentage of Total Sales

This figure is high for Pantaloons and Westside as compared to other retail outlets (Exhibit 6).

Exhibit 6 Sales of PLBs as percent of Total Sales

Exhibit 6 Sales of PLBs as percent of Total Sales

c. The retailer strategy of introducing private labels in a category depends on consumer purchasing pattern in different regions, space availability (square feet) in the store, expansion strategy, timeline and market research studies.

d. Specifically, Westside finds it difficult to attract young men towards private labels, as the male segment is loyal to the established brands in the market.

Strategies for Growth of Private Labels

Private labels are currently in a growing stage. For the fruitful growth of PLBs, the retailers need to focus on certain strategic factors. We suggest the following ideas for the same:

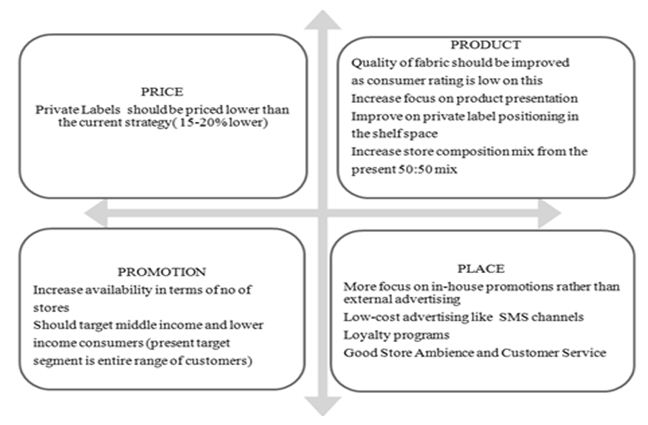

a. As per the snake diagram and other findings, it was inferred that Reliance Trendz is lagging behind in comparison to other retail chains. To compete with the other retail chains who already have a strong hold in the market, they need to focus on their marketing mix strategy i.e. 4Ps which we recommend below in Exhibit 7.

b. When it comes to purchasing apparels, consumers always look for fit and comfort. From the findings it was found that private labels have a low ranking on reputation factor. To address these issues, retailers should focus on the attributes like proper fit and comfort rather focusing on pricing and advertising issues.

Exhibit 7 Marketing Mix Strategy for Reliance Trendz

Exhibit 7 Marketing Mix Strategy for Reliance Trendz

c. One of the new insights found from retailer’s empirical studies was that men are not frequent buyers of PLBs. Even consumer’s survey analysis shows us the same response in the menswear (shirts) category. To gauge the interest of men, consumer research should be conducted. The results should then be incorporated for the improvement of private labels in men category.

d. PLBs are found to be strong in their display aspect, while they lack in factors such as creating a strong image in the minds of consumers. So the display focus should be a part of the short term strategy; but to beat the brands or to take a similar position in the market, long term focus should be on building store brand image.

Conclusion

This study revealed the consumer’s and retailer’s perspective of private labels. The major objective of retailers' and consumers' perceptions and major challenges are explored through this study. Private labels are showing increasing growth because of the attractiveness that they offer to retailers. Their strategic growth in the current scenario should be directed along the lines of consumers’ perceptions. In the long term, the growth strategy of PLBs should be based on the combined view of consumers and retailers.

Keywords

Marketing, Consumer Goods (Apparel), Retail, Private Label, Brands, Westside, Reliance Trendz, Shoppers Stop, Pantaloons, Lifestyle

Contributors

Nagasimha Balakrishna Kanagal is an Associate Professor in the Marketing Area at IIM Bangalore. He holds a PhD from University of Texas at Dallas, USA. He can be reached at

kanagal@iimb.ernet.in .

Jyoti (PGP 2010-12 at IIM Bangalore) holds a B.E from Netaji Subhas Institute of Technology, Delhi and can be reached at

jyoti10@iimb.ernet.in .

Sangeeta Patel (PGP 2010-12 at IIM Bangalore) holds a B.Tech from National Institute of Technology, Rourkela and can be reached at

sangeeta.patel10@iimb.ernet.in .

References

-

India Brand Equity Foundation, http://www.ibef.com/, Last Accessed on Jan 26, 2012

-

Batra, Rajeev & Sinha, Indrajeet, 2000, Consumer Level Factors moderating the success of private label brands, Journal of Retailing, Vol 76, No. 2, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1334035, Last Accessed on Jan 26, 2012

-

Bhatia, Vandana, 2003, Westside – The Indian Retailing Success Story, ICMR Case Studies Collection, Case Study No – BSTR043