India Entry Strategy of Auto Majors

Faculty Contributor : J. Ramachandran, Professor

Student Contributors : Amrita Chakraborty, Sujoy Kanti Dutta, Ketan Ray and Tanvi Saraf

This article focuses on the entry strategy of global auto majors in the passenger vehicles segment of the Indian automobile industry and seeks to explain the rationale behind it. Apart from this, various entry modes (Greenfield, Joint Venture and Acquisition) have been looked at and factors which could make a particular entry mode more attractive than other options have been analyzed.

De-control, de-licensing and de-regulation of the auto-industry post the introduction of the new Automobile Policy in 1993 reduced the barriers to entry considerably. As a result, the period post 1995 witnessed a large number of global automakers making an entry into the Indian automotive market. This period coincided with the liberalization of the economy. The rising disposable incomes of Indians, especially the middle class, ushered the rise in demand for four wheelers, in a market earlier dominated by scooters or other two wheelers. In the subsequent decade, India through its abundant talent resource pool, low-cost and favorable investment climate, established itself not only as an attractive emerging market but also a favored manufacturing hub for global automakers1

Global Auto Majors Entry Strategy Analysis

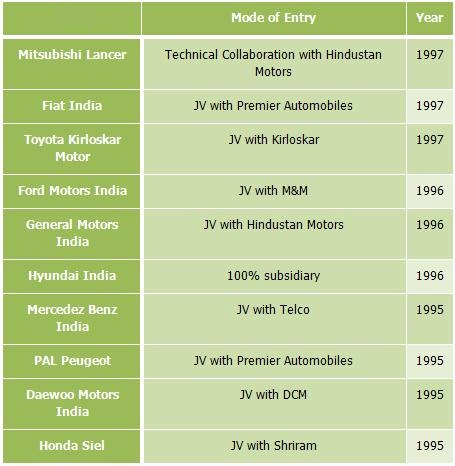

Exhibit 1 shows the entry modes of the global auto majors before 20002

Exhibit 1: Mode of Entry of Auto majors between 1995 and 2000

Exhibit 1: Mode of Entry of Auto majors between 1995 and 2000

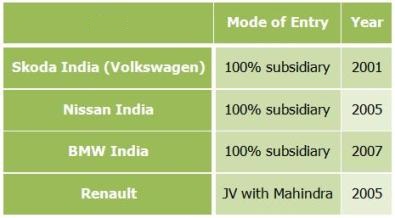

Interestingly, post-2000, the major global auto majors entering the Indian market chose to enter via Greenfield mode as depicted in Exhibit 2.

Exhibit 2: Mode of Entry of Auto majors post 2000

Exhibit 2: Mode of Entry of Auto majors post 2000

This trend in entries raises a few pertinent questions:

-

Why did most global auto majors choose to enter through the joint venture mode before 2000 and why was there a distinct change in the entry modes post 2000?

-

On what basis did the foreign majors choose their joint venture partners when most Indian partners were not in related industries?

Mode of Entry – Potential Options

A global auto major may choose to enter a foreign market via any of the following three entry modes:

-

Joint Venture (JV) Mode

- Greenfield Mode

- Acquisition of domestic player

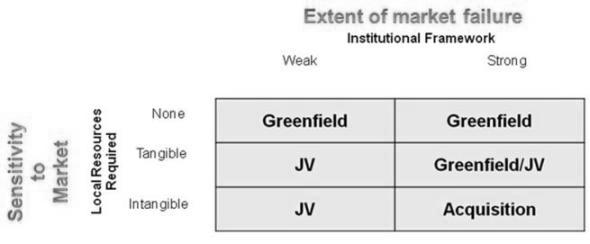

A study of the “Resource cum Institutional Framework”3 (K. E. Meyer et. All, Exhibit 3) suggests a direction towards tackling the pertinent questions raised in the previous section:

Scenario 1: Strong Institutional Context

- While acquisitions burden the acquiring firm with the task of managing the acquired businesses, JV may be susceptible to substantial coordination challenges. Thus, in case the local markets for acquiring necessary resources are efficient, it is prudent for foreign entrants to establish a Greenfield operation instead. However, this argument holds true only if the nature of resources required by the global player is of tangible nature.

-

Alternatively, even if the institutional framework of a country is strong, in case the nature of resources required is intangible (such as brand recognition or a learning curve), it may still be difficult to procure the requisite resources from the local markets. As a result, the foreign entrant will prefer an acquisition entry strategy over a Greenfield operation.

Scenario 2: Weak Institutional Context

- In case institutional voids exist within the target country resulting in inefficient markets for acquisition of resources, the foreign entrant will prefer to choose between an acquisition mode of entry and a JV. Further, the local firms would have better access to these local markets and hence, the requisite resources.

-

Efficient financial markets and mature corporate governance practices play a significant role in the success of an acquisition mode of entry. In the absence of these, an acquisition strategy may be prohibitively costly to the acquirer. For instance, in the absence of mature financial markets, resources of the acquired entity may be incorrectly over-valued. Further, post-acquisition integration typically poses a significant challenge. In such cases, a JV is a more attractive option.

-

Foreign entrants can gain access of local resources held by local firms via JVs. This may substitute for the institutional voids existing in the target market.

Exhibit 3: Institutional cum Resource based Framework

Exhibit 3: Institutional cum Resource based Framework

Indian Institutional Context

Prior to 1997, access to the following local resources was critical for a foreign entrant to make a successful entry into the Indian automotive market:

- Local manufacturing facilities: This was critical because import of vehicles in the form of completely-built-unit (CBU), completely knocked-down (CKD), or semi-knocked-down (SKD) was restricted by the government.

- Distribution network: This was essential to achieve quick market penetration and visibility. Also, it played a major role in keeping the costs low, an essential factor for the price conscious Indian consumer.

- Reliable Supplier Network: Securing low cost, efficient and reliable network of local suppliers of raw materials was essential to keep the procurement, inventory and production costs low and hence, prices competitive.

Required Access to Local Resources

At the time when most global automakers entered the Indian market, the institutional framework of the country was weak. The financial markets were inefficient and under-developed. Conducting business was contingent more on relationships rather than on contracts. The local markets for acquiring resources such as a reliable supplier network or a widespread distribution network were inefficient; there was scarcity of such resources given the immature stage of the automobile industry in India with a few incumbent players.

While JVs typically allow foreign entrants to gain access to local resources as described in previous section, on a closer examination in the Indian context, we find that their chosen domestic partners namely Hindustan Motors, Mahindra & Mahindra, PAL, etc. were not better off either. They were either new to the automotive industry or had a small insignificant market share. Consequently, the state of their resources was relatively under-developed and would have hardly sufficed the resource requirements of the global auto majors. Hence, we conclude that the access to local resources does not adequately explain why global auto majors chose to adopt JV as their preferred mode of entry strategy.

Weak Institutional Framework

The Indian Government set out several structural adjustment programs post the balance-of-payments crisis in 1991 including several economic liberalization policies. However, inspite of significant de-licensing post-1993, restriction on FDI of over 51% via the automatic route and the MoU policy indicated that the government still had interests of the domestic automobile industry at heart4. In such circumstances, obtaining approval for a wholly owned subsidiary would have been a challenge. Case by case approvals routed through the FIPB (Foreign Investment Promotion Board) for establishing wholly owned subsidiaries would delay entries of global automakers further due to the long-drawn bureaucratic approval process.

Thus, the institutional framework in the country during the period of entry of most global automakers still called for sustained interaction with the government over regulatory issues. In such circumstances, it would serve well for global automakers to be in collaboration with a domestic partner to be perceived in favorable light by the government. Thus, in our opinion, regulation was a key driver for most global automakers choosing to enter via the JV mode.

Equity Expansion Strategy of Global Auto Majors

The Auto Policy of 2002 abolished most clauses in the previous Auto Policy, easing regulations and allowing 100% FDI via the automatic route, which prompted several global automakers to either increase their stakes to near 100% in their JVs or exit the JVs all together.

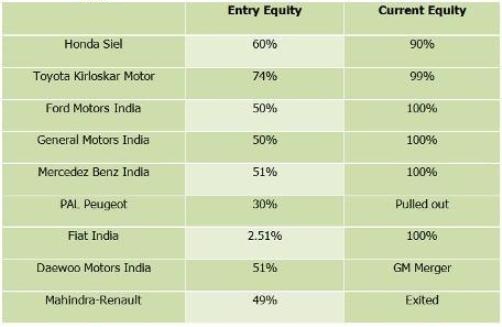

Exhibit 4: Equity stake expansion trends of Global Auto Majors

Exhibit 4: Equity stake expansion trends of Global Auto Majors

Exhibit 4 illustrates how the foreign entrants expanded their equity stake with relation to their Indian partners.

The mode for expanding their stake was either by investing more in the expansion of the capacity or by buying the stakes from the partners. Since none of them were listed companies, the mode of financing was mainly from parent companies. Some firms like Honda and Hyundai were borrowing money from Indian banks and financial corporations like ICICI. Compared to Indian owned firms in the private corporate sector, the ratio of fixed capital formation to total use of funds by foreign firms was lower.

In our opinion, global automakers chose to increase their stakes/exit the JVs because of:

- Inadequacy in local resources provided by the domestic partners (as discussed in previous sections)

- Indian JV partners’ inability to invest their share of capital resources towards capacity expansion.

- Foreign partners increasingly narrowed the knowledge gap by developing capabilities to either negotiate or substitute institutional voids. Thus, their dependency on local partners in dealing with local institutions and government significantly decreased over time.

This increase in equity stakes of foreign partners in the JVs over time and the JV exits further corroborate our deduction that most global players chose to enter through JV mode mostly due to regulatory reasons and not to gain access to local resources. As soon as the regulations were eased and the FDI limit was increased via the automatic route [51% (pre 1997) -> 75% (in 1997) -> 100% (2002)], the global players took the opportunity to expand their equity stake. Thus, the joint ventures formed were opportunistic rather than strategic in nature.

Conclusion

A clear trend can be observed in the mode of entry of global auto majors in the Indian economy: Pre-2000, all global auto majors chose to enter through the joint venture mode. Post-2000 however, the mode of entry of global auto majors changed to Greenfield. Incumbent foreign players expanded their equity stake in joint ventures to form fully owned companies. This article was an attempt to rationalize the choice of the mode of entry of global auto majors in the Indian industry in the context of institutional voids existing in Indian automotive market.

Keywords

Indian Automotive Industry, Strategy, Joint Venture, Acquisition, Greenfield

Contributors

J. Ramachandran is a Professor in the department of Corporate Strategy and Policy at the Indian Institute of Management, Bangalore. He holds a Ph D from IIM Ahmedabad, India. He can be reached at

jram@iimb.ernet.in.

Amrita Chakraborty (PGP 2009-11) holds a B.Tech from NIT Allahabad and can be reached at

amrita.chakraborty09@iimb.ernet.in.

Sujoy Kanti Dutta (PGP 2009-11) holds a B.E from Jadavpur University and can be reached at

sujoy.dutta09@iimb.ernet.in.

Ketan Ray (PGP 2009-11) holds a B.E from Netaji Subhas Institute of Technology, Delhi University and can be reached at

ketan.ray09@iimb.ernet.in

Tanvi Saraf (PGP 2009-11)holds a Bachelor’s degree in Chemical engineering from Indian Institute of Technology, Bombay and can be reached at

tanvi.saraf09@iimb.ernet.in .

References

-

State of the Automotive Industry, CRISIL Research, June 2009

-

Chandra, P. and Sagar, Ambuj D ., “Technological Change in the Indian Passenger Car Industry” John F. Kennedy School of Government Discussion Paper 2004 – 2005 , June 2004 , pp . 1 – 57

-

Meyer, K., Saulestrin, B., Kumar, S., and Peng, M., “Institutions , Resources, and Entry Strategies in Emerging Economies”, Strategic Management Journal J.30, Sep 2008, pp. 61 -80

-

Jarugumalli, V. and Gayithri, K. “Multinational Enterprises in India: A Case Study of Indian Automobile Industry”, Institute of Social and Economic Change Banglore, PhD Thesis, Dec 2006, pp. 150- 252