Future of Retail in India with Emphasis on Consumer Durables

Faculty Contributors : Ashis Mishra, Assistant Professor and Roger Moser, Visiting Faculty

Student Contributors : Monojeet Sinha and Ravi MV

After the recent global financial recession, consumer spending in developed countries is very low. However, backed by robust economic growth and favorable demographics, Indian retail sector is bound to see an accelerated period of growth. Firms need to foresee ways to create and improve capabilities and to recognize opportunities in a value generating way. This article looks at the future of how this market for consumer durables would shape out over the period of next ten years.

Indian Retail Sector and Consumer Durables Segment

Within retail industry, customer appliances are worth of Rs. 297,285 million with a YOY growth rate of 13.3%. Traditionally the unorganized retailers dominated consumer durables segment but huge growth potential is attracting large corporate organisations to expand their retail operations into this territory. Until recently majority of sales in consumer durables were originating from urban centers but with change in demographics and increasing exposure, the growth in sales volume from rural areas are projected to be higher than urban areas. With the revival of western economy after the recession being slower than anticipated, large global retailers are also looking forward to expand their business in India1. Also with increase in awareness, Indian customers are increasingly demanding more value for money both in terms of quality of durables and convenience of buying2.

Using the PEST framework and scenario based approach we aim to create an understanding of the state of the retail sector and consumer durables segment in India at present and to develop a clearer picture of how the consumer durables retail market would shape out towards the end of this decade.

Methodology

Initial stage of the study consisted of interacting with experts and developing potential end states in the political, economic, social and technological environment of the consumer durables segment. During the process, we identified enablers by various stakeholders involved. In the second phase, we sought opinions from experts using the Delphi study approach on the probability of occurrence of these outcomes, their possible impact and desirability for the Industry. In the third phase, we analyzed expert’s opinions to develop a picture of the industry over this decade and then identifying the key opportunities.

Looking into the Future

Outcome Projections

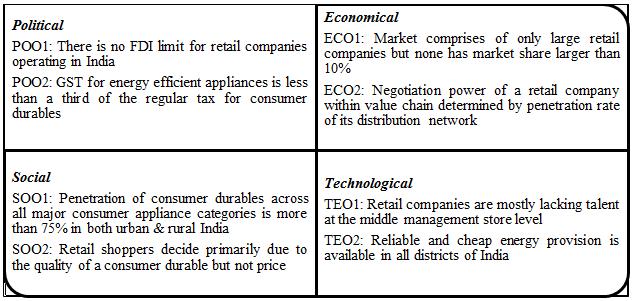

Based on interactions with industry experts and secondary research following eight outcome projections are developed. Each of these projections addresses a key development expected by end of the decade i.e. year 2020. Refer to Exhibit 1 for the outcome projections in year 2020.

Exhibit 1: Outcome projection by year 2020

Exhibit 1: Outcome projection by year 2020

Enabler Projections

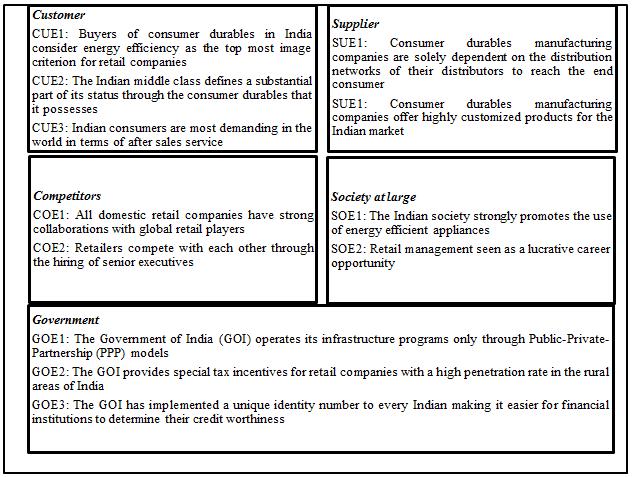

Using the above projections, we developed scenario matrices, each based on the combination of outcome projections of the same environment. These scenario matrices helped us to identify key future actions (enabler projections), which the following stakeholder groups must make for respective scenarios expected to fructify in next ten years. Refer to Exhibit 2 for the enabler projections of various stakeholders.

Exhibit 2: Enabler projection by stakeholders

Exhibit 2: Enabler projection by stakeholders

Analysis of the Projections

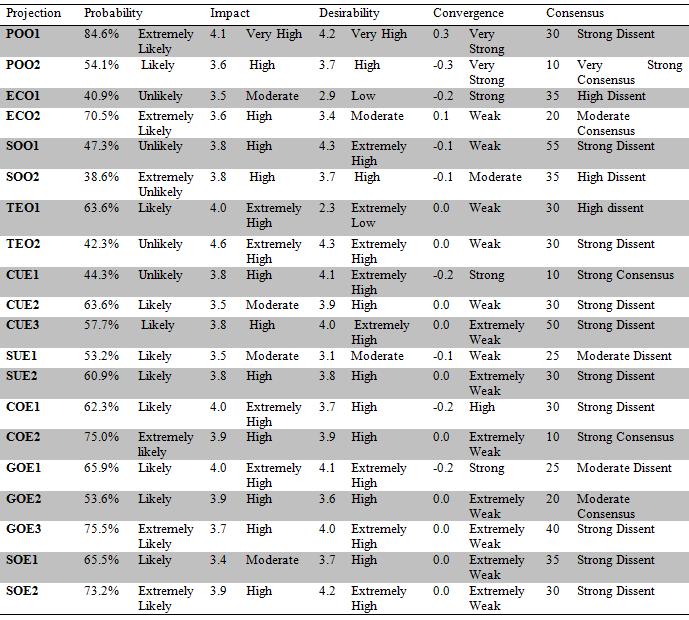

Exhibit 3 provides details about how the industry experts have responded to the probability of occurrence of these outcomes, their possible impact and desirability for the Industry.

Exhibit 3: Expert’s opinions on Probability of Occurrence, Impact on Industry and Desirability of projections

Exhibit 3: Expert’s opinions on Probability of Occurrence, Impact on Industry and Desirability of projections

POO1: Experts agree that this scenario has high possibility of occurrence and would have a high impact. This is also extremely desirable, as it would increase competitiveness leading to major improvements in supply chain and penetration distribution network.

POO2: Experts agree that this scenario has high impact, desirability and possibility of occurrence, as more energy efficient appliances would lead to lesser wastage of electricity. However, few experts feel that consumer preference by rather than by government, intervention would influence this scenario.

ECO1: Experts seem to agree that large retailers would dominate the market but they seem to have diverse opinions about market share of these players. However, they seem to agree that having limited players is not desirable for expansion of market.

ECO2: Most experts seem to agree with that retailers with greater reach would be able to provide more exposure and sales, this would increase negotiating power of retailers within the value chain. It would have high impact on industry, as this would push the retailers to increase their reach even in rural areas.

SOO1: Experts seem to not agree that penetration of consumer durables would reach a level of 75%. They feel that lack of infrastructure would prevent the penetration to reach such high levels. This projection high impact and desirability as high penetration would mean a high growth in sales.

SOO2: Experts seem to not agree that customer’s primary buying decision is quality of a product but not price. They feel customers at bottom of pyramid would ensure that considerable demand always exists for the low price goods.

TEO1: Experts strongly agree that retailers would be lacking talent at middle management. Majority believe that in-house training is only way out to minimize the gap between supply and demand. It would have high impact because lack of talented resources would be major bottleneck in growth of market.

TEO2: Current infrastructure penetration significantly lags the demand and hence experts feel that it is unlikely that reliable and cheap energy provision is available in all districts of India by 2020. The projection is considered high impact and highly desirable as it would mean high penetration of consumer electric appliances across India.

CUE1: Majority experts feel that it is unlikely that buyers of consumer durables in India consider energy efficiency as the top most criterions influencing their purchase decision. The major buying criterion for majority customers would still be lower price.

CUE2: Experts feel that it is highly likely that Indian middle class would define a substantial part of its status through consumer durables that it possesses. This projection has high desirability, as this would provide more options for retailers and manufacturers to serve the customer needs rather than on low price.

CUE3: Experts feel that projection has high possibility of occurrence and Indian customers would be demanding more value for their money. But in rural customers would not be aware of various services offered and trends would be in favor of low cost goods.

SUE1: Experts feel that it is likely that Consumer durables manufacturing companies do not have expertise of retailers when it comes to distribution network and hence would be dependent on retailers’ distribution to reach end customers.

SUE2: Experts feel that it is likely that Indian consumers are more demanding about value for their money and manufacturing companies would be willing to provide customized products for Indian market. But rural consumers would still prefer long durable goods rather than customized products.

COE1: Experts agree that domestic retailers need to collaborate with the global retailers to leverage on their expertise of operating large stores. Global retailers would also benefit from expertise of domestic retailer in the Indian market.

COE2: Experts feel that given the shortage of talented resources retailers would compete in poaching senior executives from each other. This projection also has high desirability because the firms, which possess employees with specialized expertise in retailing, would have competitive advantage.

GOE1: Experts agree that government implements majority of its infrastructure development programs through PPP models. Experts believed that these projects would have lesser delays and much better implementation. This scenario has both high impact and desirability because better infrastructure would increase the sales of consumer durables.

GOE2: Financial inclusion is one of major priority of Indian government. Hence, the experts agreed that government would provide incentives for retailers who concentrate on expansion in rural areas. This scenario would have a high impact and desirability, as this would fuel the growth of distribution network.

GOE3: Experts agreed that by year 2020, every Indian would have unique identity number, which would help financial institutions to determine credit worthiness of individuals. They agreed that such scenario would facilitate extension of credit by these institutions, which in turn would fuel sales of consumer durables.

SOE1: Experts agree that because of increasing awareness about greenhouse gas effect or due to decrease in electricity costs, Indian customers would prefer the usage of energy efficient appliances.

SOE2: Owing to shortage of talented human resources, retailers would aggressively compete for hiring which would increase the salaries in the sector. Therefore, experts seem to agree that Indian society considers retail as a lucrative career opportunity.

Projections Summary

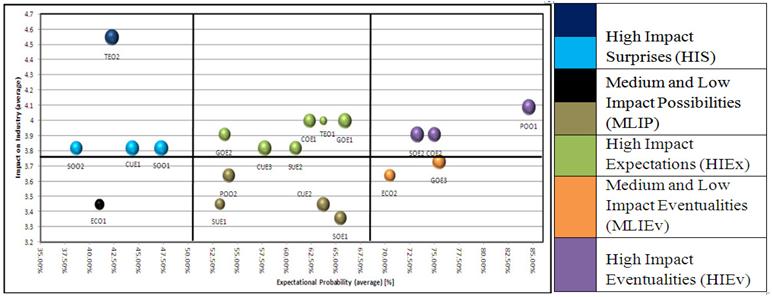

Exhibit 4: Cluster analysis of projections

Exhibit 4: Cluster analysis of projections

*Size of the bubble indicates the desirability.

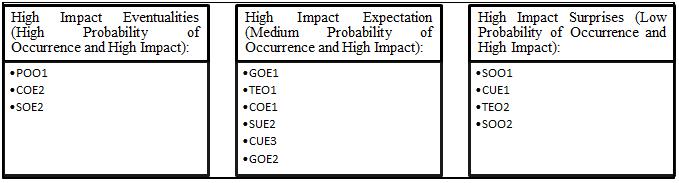

We have classified the projections into the following clusters as shown in the Exhibit 4. Because of their high impact, the categories listed in Exhibit 5 should be of strategic importance to retailers.

Exhibit 5: Classification of high impact projections

Exhibit 5: Classification of high impact projections

Recommendations – Focus Areas

In order to be build capabilities to compete with global retailers domestic players should players should currently focus on

- Collaborating with foreign players

- Form joint ventures with global majors

- Leverage their expertise to improve the effectiveness of logistics

Retailers should focus on following aspects to counter the challenge of shortage of talented human resources.

- Develop Talent Pool

- Targeting fresh graduates and projecting retail as lucrative career option for them

- Career growth of employees: In-house training to build employee capabilities

- Retention of employees

Success of retail operations depends on the penetration of their distribution network. Retailers should therefore focus on following aspects to increase the reach of the distribution network

- Collaboration with 3rd party logistics service providers

- Increase the presence in Tier 2,3 cities and rural areas

- Increase the investment in IT technology to manage large distribution networks

Retailers should focus on following aspects to attract Indian customers would be one of the most demanding customers in the world.

- Expanding after sales service to both urban and rural areas

- Increasing the availability of private label brands in rural market

- Extending credit facilities

With middle class associating social status with the consumer, durables possessed by them retailers should concentrate on catering to these customers by providing innovative and integrated home solutions. They could concentrate on the following aspects to cater to these markets

- Develop relationships with innovative manufacturing companies

- Increasing the integration with suppliers to develop customized products

Conclusion

Based on the study we could conclude that over the next decade consumer durables retail market has high growth potential and retailers would fiercely compete to increase their market share. The study was able to identify scenarios, which would have high impact on the industry. Firms operating in consumer durables segment should keep an eye for these developments in order to be ready for such scenarios. Furthermore, the present study has been successful to the extent of revealing the key areas where the retailers have to concentrate in order to remain ahead of the competitors. They are a) Collaboration with global retailers b) Workforce management c) Expansion of distribution network d) Offering world class services e) Relationship with suppliers that drive innovation.

Keywords

Retail, Consumer Markets, Marketing, Strategy, Retail, India, Future of Indian Retail, Consumer Durables

Contributors

Prof. Dr. Roger Moser is visiting faculty in the Production & Operations Management area and is EADS-SMI Endowed Chair for Sourcing and Supply Management at IIM Bangalore. He holds a PhD in Sourcing and SCM from European Business School, International University. He can be reached at roger.moser@iimb.ernet.in

Ashis Mishra is an Assistant Professor in the Marketing area at IIM Bangalore. He holds a PhD in Business Administration from Utkal University, Orissa. He can be reached at ashism@iimb.ernet.in

Monojeet Sinha (PGP 2009-11) holds a B.E in Civil Engineering from Indian Institute of Technology, Guwahati. He can be reached at monojeet.sinha09@iimb.ernet.in

Ravi MV (PGP 2009-11) holds a B.Tech. in Electrical & Electronics Engineering from Jawaharlal Nehru Technology University College of Engineering, Hyderabad. He can be reached at ravi.v09@iimb.ernet.in

References

- “Strategic Issues for Retail CEOs* - Perspectives on Operating in India’s Retail Sector” by PricewaterhouseCoopers (http://www.pwc.com/en_IN/in/assets/pdfs/retail_report.pdf), last accessed on Oct 07, 2010.

- Consumer Appliances – India, Euromonitor International: Country Market Insight April 2010 (http://www.portal.euromonitor.com/Portal/accessPDF.ashx?c=13\PDF\&f=F-149853-17782813.pdf&code=sqrrtzDKqbUawHMyq1cAIAcpYak%3d), last accessed on Oct 07, 2010