Banking the Unbanked – An Indian Perspective

Faculty Contributor : Ganesh N. Prabhu, Professor

Student Contributors : Pankaj Ranjan and Rohit Sharma

The banking industry in India has shown tremendous growth over the last decade. However, this growth has not reached vast segments of the population, especially the under privileged sections of the society. The article proposes a new business model by studying the state of financial exclusion in India and its causes. This study depicts how a mobile phone based platform can be used to expedite the process of financial inclusion leading to lower transaction costs. The research generated a series of implementable suggestions that can be used to make the model more robust

Introduction

Much has been talked about the poor state of financial inclusion in India. As of 2009, 51.4% farmer households are financially excluded from both formal or informal sources (45.9 million out of 89.3 million)1. 73% of all farmer households have no access to formal sources of credit. India is placed at the 50th position in the overall ranking of financial inclusion in the world and has the second highest number of financially excluded households in the world after China2. The extent of financial exclusion indicates the inefficiency of the existing financial inclusion models which lead to high transaction costs. The huge number of under-served Indians defeats the purpose of the establishment of banking systems, causing the citizens to lose faith in the system.

This study is aimed at analyzing the present state of financial exclusion and its causes, with the objective of coming up with implementable business models for financial inclusion which will lead to:

- 1. Increased reach of financial services and making services available to the “bottom of pyramid” population, and

- 2. Reduction in the transaction costs for providing financial services.

Methodology

In order to understand the challenges faced by the currently existing models in comprehensively catering to the financially excluded citizens, the business model of FINO (Financial Information Networks & Operations Ltd.) was analyzed. It is a pioneer company in providing technology solutions to enable financial institutions to reach out to the under-served & the unbanked sector of India. The main challenge is – How to make efficient use of the existing infrastructure in a complementary/supplementary way to enhance the reach (defined as accessibility) and reduce the cost of financial services. The capability/potential of mobile phones in resolving the accessibility issues in India was analyzed through various survey reports and growth reports in telecom sectors. To develop a comprehensive idea of efficient usage of mobile phones in providing services, we studied the business model of ngpay, which is India's first end-to-end, mass market mobile commerce service provider. It uses a mobile based platform to provide various services like purchase of movie tickets etc.

The proposed business model i.e. “mobile phone based platform for financial inclusion” is a hybrid model of the above mentioned models with numerous modifications in order to make the model compatible with the Indian scenario. An important point to note here is that the model has been developed keeping in mind the political, economic and regulatory situation of India and hence, is applicable to India. However, it can be applied to other developing nations as well with slight adjustments.

Proposed Business Model

This section highlights the main components of the proposed business model and gives an overview of the process flow of the proposed model. Market segmentation and services to be provided are also highlighted upon. The financial analysis for the proposed model is presented in the end.

Proposed Business Model

The proposed model contains three key components:

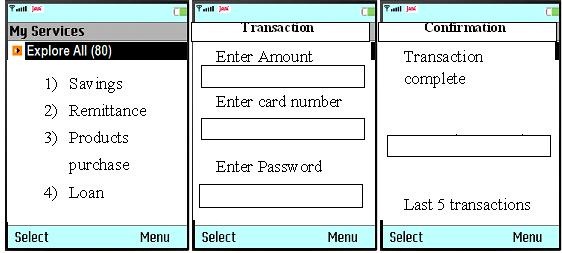

- a) Mobile based front end: Easily downloadable mobile based platform which will act as a front end for the transaction. The user will be able to select from multiple transaction options and once the option has been selected it would be followed by customer identification & transaction confirmation steps. (Refer Exhibit 1)

- b) Technology Bank-end: A technology backend solution would be used for managing the transaction lifecycle, mobile platform management, and customer account maintenance. This Core Banking Solution (CBS) will be used to collect transaction data, to update the Customer Information File (CIF) of the beneficiary, and to provide third party support solutions to Financial Institutions. The solution will be capable of managing multiple interactions with multiple banks.

- c) Banks and other Financial Institutions (FIs): Proposed business model has two sets of clients (1) the financially excluded individual/beneficiary, and, (2) the financial institutions interested in profitably serving the huge untapped market of financially excluded areas in India. The model will significantly reduce the cost of financial inclusion and will provide an opportunity for these financial institutions to outsource their customer acquisition and maintenance tasks.

Exhibit 1 Mobile based front-end (English Version – Also to be made available in other languages)

Exhibit 1 Mobile based front-end (English Version – Also to be made available in other languages)

Business Process Flow

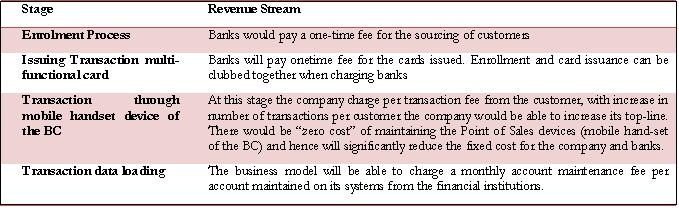

Step 1: Enrolment Process: In the enrolment process the company’s representatives will collect data for unique identification of each individual customer including their photograph, signature, and finger prints. Enrolment will be a one-time process where the company representative will visit the individual’s location for verification. These representatives will be entitled to engage with the customers, source customers and make banking transactions with customers on behalf of the bank. Once the enrolment has been performed the customers will receive their transaction cards, and will visit these representatives from time to time to carry out banking transactions. (Refer Exhibit 2)

Step 2: Issuing Multi-functional Transaction Cards: A unique transaction card would be provided to each customer with features including:

- (a) Unique customer identity

- (b) A Card Verification Value (CVV) number, and

- (c) A multi-product delivery platform (e.g. insurance, remittance, and savings account).

Once the card has been issued to the customer it would be used to cross sell other financial and non-financial products which will increase the revenue per card with zero incremental cost thereby maximizing the efficiency of each card. (Refer Exhibit 2)

Step 3: Transaction through mobile handset device of the company’s representatives: Company Representative (CR) will receive a mobile based platform (software uploaded on his mobile phone) which will form the interactive base for the transactions. CR will carry out the transactions on behalf of the customer and the customer will only have to enter his unique password to authenticate the transaction. The company will provide these passwords directly to the customer through a pictorial user manual giving directions on how to press the password keys. The customer will have the option of receiving transaction confirmation either on his mobile phone or get a transaction receipt from the CR. (Refer Exhibit 2)

Step 4: Transaction data loading: The transaction information coming from the point-of-sales device of the CR (mobile hand set) will be directly transferred to the virtual bank accounts of the customer. The accounts will have accounting and management information system capabilities which would be in accordance with the banking standards and regulations. The company will use a Customer Information File (CIF) to keep track of the multiple customer relationships across various products. (Refer Exhibit 2)

Exhibit 2 Revenue streams for the business model

Exhibit 2 Revenue streams for the business model

Segmentation of market & proposed services

To cater to the needs of the market, it is very important to segment the market and provide products and services that suit their specific needs. We define our market as the financially excluded population of India and segment it as follows:

- (a) Established ones: This segment is defined as the set of rural population who are capable of depositing Rs. 2000 in their savings account as a minimum account balance. They have not been able to open an account because of the absence of bank branches or lack of trust or financial knowledge. Hence, the model proposes to open a permanent bank savings account and would act as a mediator between these people and the bank to minimize their efforts. The target segment would have physical access to their accounts in the nearest bank branch (however far it may be!) which would act as a factor of trust. The only effort the model has to put in order to capture this segment is to educate this segment about the financial services being offered.

- (b) Aspirants: This segment is defined as the set of rural population who has the capability of keeping at least Rs. 500 and at most Rs. 2000 in their saving account as a minimum account balance. Banks are unwilling to provide savings facility to this segment because of their low transaction capability and increased risk of default. The model proposes to have a permanent savings account in bank but with no physical access to the account. The lack of physical access to the account would incentivize the banks to provide them with saving services (as it reduces their cost considerably).

- (c) Strugglers: This segment is defined as the set of rural population who does not have the capability to keep more than Rs. 500 in their saving account as a minimum account balance. This segment is extremely poor and the banks are unwilling to open accounts for them because of the extremely high risk, lack of transaction making power and inability to maintain minimum account balance. The importance of this segment cannot be undermined as almost all of these people are financially excluded and a huge potential lies within this segment if there is a proper model in place to cater to this section. The model intends to use a pay and use cash card system for this segment wherein one can pay cash to get his/her card filled. He/she can transact using that card till the card has cash. The advantage of this system is that there is no bank involved and it is a simple system to make them familiar with.

Financial Analysis

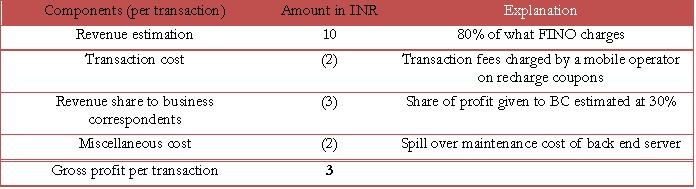

Revenue per transaction has been estimated as 80% of the current transaction charges prevailing in the market (as a discount). Cost analysis per transaction has been explained in Exhibit 3.

Exhibit 3 Profit analysis of the business model

Exhibit 3 Profit analysis of the business model

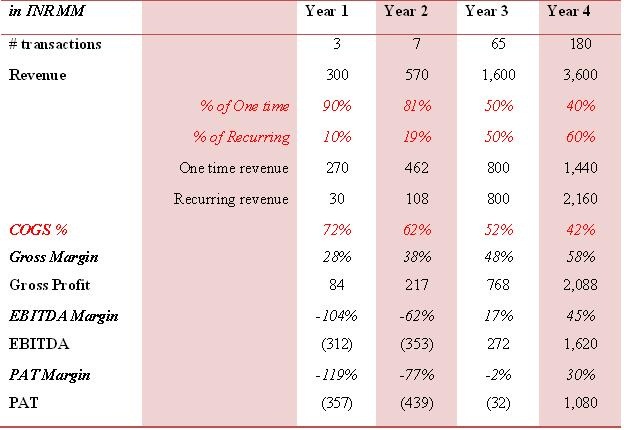

The financial statement of proposed model has been projected based on our estimates. Exhibit 4 shows the projections. It can be clearly seen that the break even is occurring around year 3 which is possible because of huge untapped potential in the Indian market. The steady state of profit margin of 30% is reached year 4 onwards. The model assumes COGS and EBITDA margins which is an improvement over the expected margins of current players. The Year 1 COGS margin of the business is around 28% after which the model assumes improvement of 10% over subsequent years (due to economies of scale).

Exhibit 4 Projected annual financial statement for the business model

Exhibit 4 Projected annual financial statement for the business model

Conclusion

Apart from resolving the accessibility issues, the cost analysis of the proposed model suggests that the use of a new mobile based platform can add significant value to the efficiency of the financial inclusion system. It, therefore, helps in enhancing the reach of financial inclusion in a viable cost efficient way. Segmenting the “Bottom of pyramid” population & providing differentiated services for each one of them would go a long way in helping the model capture its target market in the future.

The break even in the 3rd year demonstrates the potential of this business in India. The Indian Government is taking every step possible to improve the condition of financial inclusion and we expect the Government to be supportive to our model in the near future. Once the model captures the first mover advantage, it can be used to extend the business in future. E.g. the model would have the unique databases of people who were financially excluded which can be used to provide other financial and non-financial services to them. This study can be further extended to explore these future opportunities.

Keywords

Financial inclusion, FINO, ngpay, India, Business model, strugglers, aspirants

Contributors

Ganesh N. Prabhu is a Professor in the Corporate Strategy & Policy area at IIM Bangalore. He holds a Ph. D. from Indian Institute of Management Ahmadabad and a Masters from Institute of Rural Management Anand. He can be reached at gprabhu@iimb.ernet.in

Pankaj Ranjan (PGP 2009-11) holds a B.Tech from Indian Institute of Technology, Kharagpur and can be reached at pankaj.ranjan09@iimb.ernet.in

Rohit Sharma (PGP 2009-11) holds a B.Tech from Indian Institute of Technology, Bombay and can be reached at rohit.sharma09@iimb.ernet.in

References

NABARD report on “Nature and extent of financial exclusion in India”, http://www.nabard.org/pdf/report_financial/Chap_II.pdf.

ICRIER, “Report: Index of financial inclusion: India ranks low in financial inclusion”, http://www.financialexpress.com/news/india-ranks-low-in-financial-inclusion-icrier/339450/.