Rural Financial Intermediation: A study in tribal Areas of Jharkhand

Faculty Contributor: A. Damodaran, Professor

Student Contributors: Chandrasen Guria and Asmita Kachhap

This article explores credit availability in tribal areas of Jharkhand and identifies factors which determine credit accessibility, reasons for the underdeveloped state financial institutions, legal and social complexities involved, traditional credit flow and possible intervention. The article argues for a system of local self government where the local traditions and tribal customary laws take precedence (termed as the end-exogenous) over a system in which the state plays the driver role (termed as the ex-endogenous).

Rural tribal areas of Jharkhand were totally isolated from the external financial systems until five decades ago. Even now, these areas are so underdeveloped that barter system is still prevalent1. Although the need for credit is not significant, the requirement is different with credit required mainly in agricultural activities which also include activities related to non timber forest produce (NTFPs). The tribal people have very few assets which primarily include land, cattle and trees. Land in these areas is treated as a source of livelihood and not a commodity. This leads to a lot of hesitation on the part of a loan seeker to mortgage his land in order to access credit2.

Besides this, the tribal people observe collectivism in economic activities as well as in the ownership of land. Individuals are allotted land for cultivation and to earn a living, but do not have the right to transfer the ownership of land without the prior permission of the clan. This makes it very difficult for financial institutions to seek land as collateral for loans. The collective nature of land occupancy gives rise to faulty valuation methods which are unable to determine the monetary worth of land.

The tribes having their own system of trading land and are not very familiar to the concept of paper money. Thus, they do not possess adequate skills to appropriately use the money received as compensation from the land. The tribes of Jharkhand usually borrow small sums of money at regular time intervals which are often too small to obtain through mainstream banks. Therefore instead of monetization of land, emphasis should be put on capitalization of land. In this case, the tribal land can be used for generation of a steady stream of revenue under suitable lease contract over a period of time.

Methodology

We studied these factors by interacting with an expert group comprising of present and past ministers, civil servants, academicians, lawyers, anthropologists, bank officials and social workers. The research methodology included in-depth interviews of experts, ethnographic study and observation techniques.

Secondary research was conducted by studying various legal and anthropological magazine articles, research papers and books. We also studied the roles of major financial institutions in these areas such as NABARD, Jharkhand Grameen Bank, Bank of India (Lead District Bank), Catholic Cooperative Bank (a private cooperative bank), and secondary financers such as money lenders and non government institutions in order to understand their impact on the borrowing pattern of the tribes.

We have detailed the findings of our primary and secondary research under different heads that represent the major issues explored.

Legislation

There are several statutes which govern the transfer of ownership and title of land along with developmental policies in these areas. The features of three such acts namely, PESA (Panchayats Extension to the Scheduled Areas) Act, 1996, the Scheduled Tribes (Recognition of Forest Rights Bill) Act, 2005 and the CNT (Chotanagpur Tenancy) Act, 1908 were studied extensively and implications of the statutes given in the acts were explored. While these Acts have been very helpful in preserving the tribal traditional and customary laws as well as their heritage, they have also proved to be a hindrance in acquisition of financial resources.

Rural Credit System

Our study indicated that although there was adequate availability of finance from the mainstream financial institutions in the tribal areas of Jharkhand, the tribal people were reluctant to approach them. They preferred borrowing in small amount from the traditional money lenders or asked for assistance from middlemen (locally known as ‘dalals’), which invariably resulted in exploitation. This behavior can be attributed to land mortgage issues, factors such as fear of approaching authorities, shyness from outside world, illiteracy and inability to complete the forms required for obtaining the loans.

Traditional Model

An insight into the customary and traditional financial models operating in the tribal areas was very helpful. One of the most successful indigenous financial models working in these areas is known as ‘Gola Ghar’. These are traditional financial systems developed by the tribal community over the ages. The ‘Gola Ghar’ is operated by a ‘Gola Commitee’ which consists of eminent people of the tribe or the village. It essentially has a store house or godown known as ‘Gola Ghar’ which stores rice grains. If a villager does not have seeds to sow in his fields, he can approach the ‘Gola Commitee’ and borrow seed grains based on a fixed unit called ‘Paila’. A ‘Paila’ is a cup which can hold about 1.5 Kgs of rice grain. At the end of the season, after the harvest, the villager has to return the same amount of grain which he had borrowed earlier from the ‘Gola Ghar’. This system also reflects the community-sharing of resources prevalent among many tribal communities.

The mode of documentation and record keeping for such committees is not very clear. We do not have sufficient data to claim that they were being documented. Till date, most of the transactions in these villages happen through promises and verbal contracts. Now-a-days, the ‘Gola Committees’ have started similar interactions with money as well, but the lack of a good documentation process proves to be a hindrance in the efficient functioning of such a system.

The Tribal Way of Life

The basic philosophy underlying the tribal way of life is that communities developed along their self-determined path without external cultural influences and therefore had endogenously managed systems before the colonial state. However, after the Indian Forest Acts of 1865 and 1878 which were enacted for the purpose of introducing an exogenous management regime, the tribal areas in Jharkhand transformed into a supra-local, exogenous authority that assumed a commanding position in the management of forest and wildlife resources of which belonged to the tribes. (See Exhibit 1)

Exhibit 1: The Tribal Way of Life

Exhibit 1: The Tribal Way of Life

As a result of this, the forest management regimes in these areas regressed from a state of “endogenous singularity” to that of “exogenous singularity”, leaving out the participation of tribes in the affairs of the forest and the state.

IAlthough the introduction of the National Forest Policy in 1988 created conditions for an ex-endogenous form of management, wherein local communities participated as junior partners of the forest department in the management of forests, the interventions were not fruitful in practical terms3. In this paper, we argue that the end-exogenous systems, where the tribal people run the local self government and the State Government plays the junior partner role can prove as an effective way to bring about such interventions.

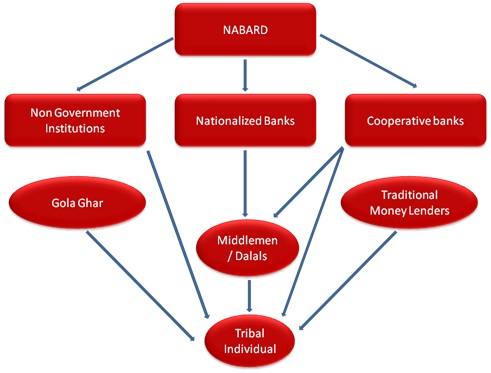

We have designed a financial model and suggested that the financial system should be made end-exogenous, where the tribal financial systems gain precedence over the state financial machinery and the role of the state is only to facilitate these systems. The original structure of the system can be seen in Exhibit 2 where the government interventions are primarily through NABARD and the money is channeled through banks and NGO’s. This system is also characterized by minimal co-operation among the participating organizations. SHGs and co-operative banks still need to avail funds at a higher rate from the nationalized banks and NABARD.

Exhibit 2: Original Tribal Financial System

Exhibit 2: Original Tribal Financial System

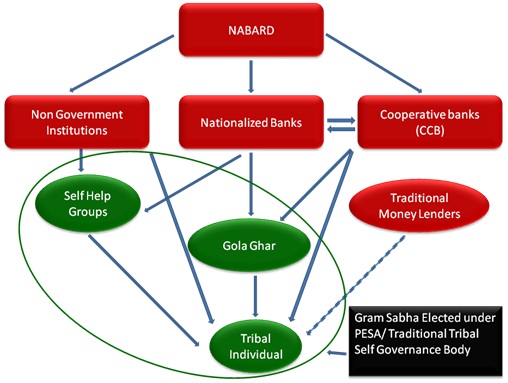

The modified model which we recommend can be observed in Exhibit 3. Here the organizations which are nearer to the ground get greater role to play. These institutions have a better understanding of the varying credit needs of tribal people and hence can structure their products to suit these needs. Government can set up funding agencies and regulatory authority to monitor the health of these institutions.

Exhibit 3: Modified Tribal Financial System

Exhibit 3: Modified Tribal Financial System

Based on statutory implications, we have drawn these solutions to enhance the monetization of land and increase the capitalization of land through more appropriate lease agreement conditions. The tribal customary institutions such as Gola Ghar are included in the loop. They get funding and other technical expertise from the nationalized banks. SHGs are controlled by the Village Panchayats elected under PESA. Efficient functioning of these institutions will drive down the interest rates charged by the moneylenders.

Finally, we have made recommendations for filling infrastructural gaps; development of adequate irrigation facilities along with good storage, warehousing facilities and value added marketing services for monetization of the system. We suggested methods to overcome language barriers and how to increase involvement of local people. We also suggested an increase in productivity by removing the system of mono cropping, greater awareness about provisions such as crop insurance etc. and encouraged alternate means of agriculture like horticulture and floriculture to enhance the flow of money in these areas.

Leasehold Interest in Scheduled Areas

The current regulations and laws pose a problem for leasehold interest to be implemented in scheduled areas of Jharkhand. According to Chhota Nagpur Tenancy Act 1908, section 464, the tribal land cannot be leased for more than five years. The impact of this restriction is that it severely devalues the asset under consideration5.

Let us apply the Discounted Cash Flow method to value the land. In case of valuation of tribal land the quality of free cash flows as well as the time period of investment becomes an issue. Generally the cash flows from this type of land are not high as they cannot be used for business purposes. Chhota Nagpur Tenancy Act, 1908 regulates the transfer and ownership of land in the Scheduled areas of Jharkhand. According to its provisions the tribal land can be used for limited purpose such as agriculture, horticulture, etc. This limits the kind of cash flow one can generate from developing the aforesaid land. Due to limited resource the growth rate of the cash flow from the asset is also very low. Even if the land is given on lease, the tenure cannot be greater than 5 years. This curtails the present value of the land and hence tribals cannot avail bigger loan amounts from the exogenous financial institutions such as nationalized banks. Exhibit 4 is a simple example which details the effect of shorter lease hold period in terms of lower present value and lower return on capital employed in form of curtailed valuation.

The tribal lands in the periphery of towns are low priced in open market though they are shown as highly priced in government records. Land around them is highly valued as they do not come under the purview of CNTA. Generally the registry department declares land rates for large contiguous areas. While valuing the land the registry department takes the government approved rates which are based on land which are not under CNTA. Therefore the stamp duty paid for transfer of deed is high. This makes the net present value of investment in Tribal lands negative. This is another reason for the tribal people not getting good returns on their assets.

Let the cash flow/income from the asset be Rs. 1000.

Discount rate = 10%

The effect of short tenure of lease:

PV = (C*t)/(1+r)t

t = 5 years

PV = 1000*5/(1+.1)5 = 3104.60

t = 10 years

PV = 1000*10/(1+.1)10 = 3855.43

Hence we see that just by increasing the tenure of lease the PV increase by 24.2%.

The effect of lower growth rate of the cash flow/income:

Assume perpetuity

g = 2 %

PV = C/(r-g) = 1000/(.1-.02) = 12500

g = 5 %

PV = 1000/(.1-.05) = 20000

We can easily observe the significant jump in the PV if higher growth in the cash flows or incomes can be achieved.

Exhibit 4: Valuation of the Land

Conclusion

The financial model which we have proposed should overcome the shortcomings in the current financial system and enable greater access to credit for the tribal population in the scheduled areas of Jharkhand. We suggested that, the financial system should be made end-exogenous, where the tribal financial systems gain precedence over the state financial machinery. The role of the state should be to facilitate these systems. Based on statutory implications, solutions were drawn out for enhancing the monetization of assets and increasing the capitalization of land through more appropriate lease agreement conditions.

Finally efforts should be made to fill infrastructural gaps through development of adequate irrigation system, cold storage facilities and value added marketing services. Methods to overcome language barriers and increased involvement of local people are also suggested. Increased productivity by eradicating the bane of mono cropping, greater awareness about provisions such as crop insurance and encouragement of alternate means of agriculture such as horticulture and floriculture was also suggested to enhance the flow of money in these areas.

Keywords

Government, Social Sciences, Public policy

Contributors

A. Damodaran is a Professor in the Economics and Social Sciences Area at IIM Bangalore. He is also the Chairperson of the Post Graduate Programme in Public Policy and Management. He holds Ph. D. in Economics from University of Kerala. He can be reached at damodaran@iimb.ernet.in.

Chandrasen Guria (PGP 2008-10) holds a B.E. degree in Computer Science and Engineering form Birla Institute of Technology (BIT), Mesra, Ranchi. He can be reached at chandrasen.guria08@iimb.ernet.in.

Asmita Kachhap (PGP 2008-10) holds a B.E. degree in Biotechnology from Birla Institute of Technology (BIT), Mesra, Ranchi. She can be reached at sasmita.kachhap08@iimb.ernet.in.

References

- Primary research, anecdotal evidence given by Himanshu Kumar, Vanavasi Chetana Ashram in a seminar at IIM Bangalore

- Primary Research

- Damodaran A., 2006,”Tribal Forest and Resource Conflicts in Kerala, India: The Status Quo of Policy Change”, Oxford Development Studies, Vol. 34, No 3, September 2006

- Pandey R.N. Roy, 2002, Handbook on Chota Nagpur Tenancy Laws, 4th edition, 2009

- During the interview Mr. Samuel Guria, Assistant Manager, Bank of India (Lead District Bank), Ranchi also highlighted the fact that Banks are not too keen on pursuing legislative reforms as it is not their job.