Corporate Financial Restructuring:

An Analysis of Select Cases

Faculty Contributor : Jayadev M., Associate Professor

Student Contributors : Abhijit Gayen and Rakesh K Meena

This article analyses the impact of different types of corporate financial restructuring measures on shareholder wealth creation based on some selected cases. Analysed cases suggest that commonly used measures like share buybacks have not been found to be value-accretive in contrast to divestitures which generate significant shareholder value.

Corporate restructuring is the fundamental change in a company's business or financial structure with the motive of increasing the company's value to shareholders or creditors. Corporate restructuring is broadly divided into two parts: financial restructuring and operational restructuring. While financial restructuring relates to changes in the capital structure of the firm, operational restructuring relates to changes in the business model of a firm, with the aim of increasing overall shareholder value. Chief Financial Officers (CFOs) today have an array of options to choose from when it comes to corporate financial restructuring. This article will focus on the financial restructuring - i.e. restructuring the assets and liabilities of corporations in line with their cash flow needs - and evaluate the different options by looking at past cases. We consider three main areas of financial restructuring - share buybacks, demergers and debt reduction.

Share Buybacks1

In a share buyback program, the company distributes the excess cash flow among the shareholders. The shareholders get an exit opportunity at a premium price (in most cases) over the prevailing market price, while the company gets an opportunity to reduce its equity capital liability. Some of the prominent reasons of share buyback are boosting market perception, showing rosier financials, benefitting from tax gains and increasing the promoter's stake if the share price is low or there is a takeover threat.

The selected buyback cases2 that were analysed are:

- Buybacks which happened after 1999-2000, companies are selected from different industries

- Faction of shares purchased was at least 5% of total pre-buyback shares outstanding

- Buyback offer was made through a tender; a market offer is quite lengthy process that doesn't affect share price or shareholder wealth immediately

Methodology

In the study the shareholder's wealth effect from the buyback is calculated as follows:

Values of shares before announcement of buyback [A] = Pre-announcement share price x No. of shares outstanding pre-announcement

Value of shares repurchased (Vr) [B] = Offer price x No. of shares repurchased

Value of shares outstanding after expiration of repurchase offer [C] = Post-expiration share price x No. of shares outstanding after repurchase

Therefore shareholder wealth (W) effect caused by the share repurchased is given by W = C-(A-B). The rate of return of the repurchase offer (Rw) is subsequently calculated as Rw = W / Vr

Results of Share Buyback Analysis

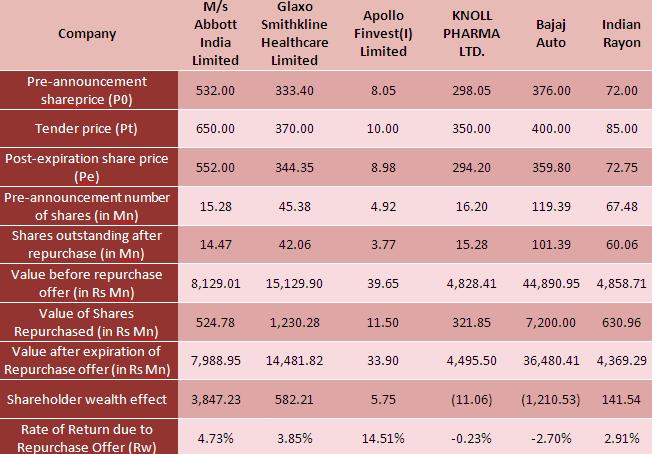

Exhibit 1 shows the results of the share buyback analysis. The bottom row presents the rate of return seen by share buybacks over a few cases.

Exhibit 1 Shareholder's wealth effect caused by share buyback

Exhibit 1 Shareholder's wealth effect caused by share buyback

Inferences from Share Buyback Study

While buybacks as a whole have helped boost returns to investors as a class, companies motives for undertaking them are not always very clear

Share buybacks have got a mixed response from the market. Based on the event-study analysis, one can draw the following conclusions

- Post re-purchase, none of the share prices were higher than the tender price, thus defeating the purpose of boosting shareholders' confidence

- In some cases, i.e. of Bajaj Auto Ltd., post-expiration share price was even lower than the pre-announcement share price, thus generating a negative return and destroying shareholder wealth

- Even in cases where there was a positive return, shareholders' wealth creation was insignificant, mostly in the range of 2-5%

Share buybacks in India send mixed signals to investors deciding whether to participate in the buyback program or not. While buybacks as a whole have helped boost returns to investors as a class, companies motives for undertaking them are not always very clear, which feeds through to the dubious returns.

Demergers

Mergers and acquisitions (M&A) refer to the aspect of corporate strategy dealing with the buying, selling and combining of companies that can aid, finance, or help a growing company in a given industry to grow rapidly without having to create another business entity. The focus in this article is on demergers, also known as spin offs. In a demerger, a firm is broken up into two or more independent entities through an initial public offering ("IPO") of a subsidiary, with the shares of the new company being distributed to the shareholders of the parent company on a pro-rata basis. A demerger is a sensible option if negative synergies or diseconomies of scale exist, which can be eliminated by separating the firm.

Methodology of Analysis: Economic Value Added (EVA)3

Any surplus generated from operating activities over and above the cost of capital is termed as Economic Value Added (EVA). It is used by companies as a performance indicator1 and is better than return on Investment (ROI). ROI measure is ambiguous while EVA is practical and understandable. Increase in ROI is not necessarily good for shareholders while increase in EVA is always good.

Case Study: Dabur India Ltd.

Dabur India Ltd. ("Dabur") initiated its demerger exercise in January 2003 after the agreement of the Board of Directors to hive of the Pharma business into a new company named Dabur Pharma Ltd. ("DPL"). After the demerger, Dabur concentrated on its core competencies in personal care, healthcare, and Ayurvedic specialities, while DPL focused on its expertise in oncology formulations and bulk drugs. The demerger would allow investors to benchmark performance of these two entities with their respective industry standards

Results of Demerger Analysis

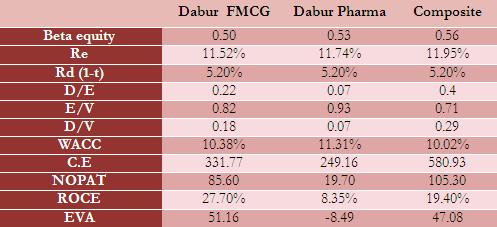

Exhibit 2 shows the results of the demerger analysis for Dabur India Ltd.

Exhibit 2 Dabur demerger calculations

Exhibit 2 Dabur demerger calculations

Inferences from Dabur Demerger Study

The results of the analysis shown in Exhibit 2 are the following:

- The Dabur FMCG business unlocked value for shareholders, since the EVA of the FMCG business was more than that of composite business. Dabur Pharma had a negative EVA, clearly indicating its capital was not properly used in the composite company.

- The total EVA of the FMCG and Pharma division was lesser than that of composite business indicating a negative synergy was present between the two divisions.

The EVA disparity between the demerged units is expected as FMCG and Pharma are two distinctly different businesses - where FMCG is a low capital intensity business, the pharmaceutical business requires higher capital due to R&D activities.

Case Study: Bajaj Auto Ltd.

The Board of Directors of Bajaj Auto Ltd agreed to a demerger on 17th May 2007. Under the scheme, BAL, the parent company, would be renamed as Bajaj Holdings and Investment Ltd ("BHIL") and the business was to be demerged into two new incorporated subsidiaries - Bajaj Auto Ltd ("BAL") and Bajaj Finserv Ltd ("BFL"). The auto and manufacturing businesses of the company would be held by BHIL while the wind power project, investments in the insurance companies and consumer finance would go to BFL. All the shareholders of the parent company became shareholders in the new companies and were issued shares of the two new companies in the ratio 1:1.

Results of Demerger Analysis

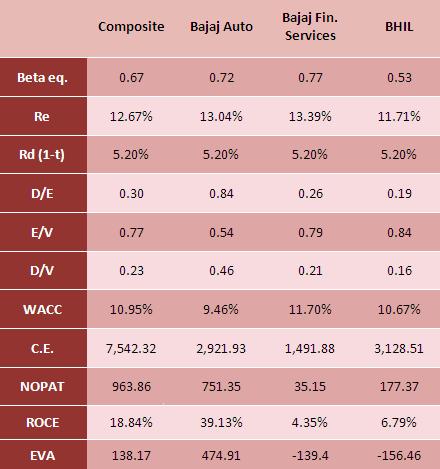

Exhibit 3 shows the results of the demerger analysis for Bajaj Auto Ltd.

Exhibit 3 Bajaj demerger calculations

Exhibit 3 Bajaj demerger calculations

Inferences from Bajaj Demerger Study

The results of the analysis shown in Exhibit 3 were following:

- The Auto division unlocked value for shareholders (its EVA more than that of composite business)

- BFL and BHIL showed negative EVA, clearly indicating that capital was not properly used by them

- The sum total EVA of the three divisions after the demerger is seen to be greater than the composite business EVA, indicating a successful value unlocking for the shareholders

Both these cases highlight that demergers can unlock significant shareholder value. The markets also reacted positively, with both scrips appreciating when the news of the demerger broke out.

Changing Debt-Equity Ratio by Debt Reduction

Debt restructuring is a process that allows company facing cash flow problems and financial distress, to reduce and renegotiate its delinquent debts in order to improve or restore liquidity and rehabilitate so that it can continue its operations. A debt restructuring is usually a less expensive and more preferable alternative to bankruptcy. The major reasons for debt reduction are maintaining healthy debt/equity ratio, reducing high interest costs and utilising cash reserves.

Summary of Analysis

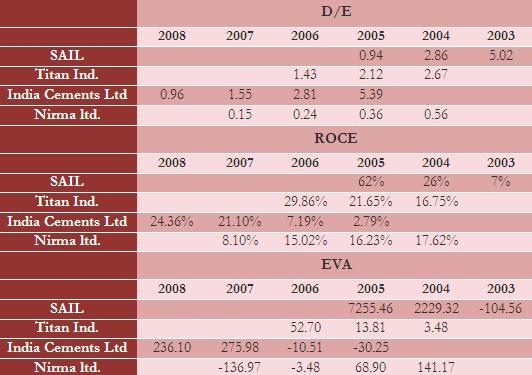

The results of the four companies' analysis of their debt reduction are summed up in the following Exhibit.

Exhibit 4 EVA calculations for debt reduction case study

Exhibit 4 EVA calculations for debt reduction case study

Inferences from Debt Reduction Study

In the cases analyzed above in Exhibit 4, it is observed that debt reduction to a certain level is generally good for a company. It was noted that:

- Companies which had very high debt-to-equity ratio generally reap the most benefit in terms of higher ROCE and EVA

- Debt reduction below a certain level is not beneficial to the shareholders & to the company because of operational inefficiencies of the company, causing its EVA to also gradually decrease.

- Debt has one intrinsic benefit for corporates - by reducing the tax burden, it increases net profit for the company, thereby creating more value for shareholders.

It can be seen that merely reducing debt with cash surplus will not necessary be good for the shareholders. It can, in fact have a negative impact on company's profitability as it increases the tax burden for the company.

Conclusion

Amongst the plethora of corporate financial restructuring options available to CFOs today, not all are equally value accretive. This article shows that share buybacks, a commonly used mechanism, often yield poor returns and are not favoured by investors. Divestitures have been shown to generate shareholder value for conglomerates when done correctly - certainly good news for a lot of Indian corporates who have diverse business interests. Finally, debt reduction is an equally viable alternative, but it suffers from diminishing returns and should be done incrementally only after careful analysis.

Authors

Jayadev M. is an Associate Professor in the Finance & Control Area at IIM Bangalore. He has a Ph.D. from Osmania University, Hyderabad. He can be reached at

jayadevm@iimb.ernet.in

Abhijit Gayen (PGP 2007-09) holds a bachelor degree in B. Tech. in Instrumentation Engineering from Indian Institute of Technology (IIT) Kharagpur and can be reached at abhijitg07@iimb.ernet.in

Rakesh Kumar Meena (PGP 2007-09) holds a B. Tech. in Electronics & Communication Engineering from National Institute of Technology Warangal and can be reached at rakeshkm07@iimb.ernet.in

Keywords

Corporate Financial Restructuring, Share Buyback, Demerger, Economic Value added (EVA)

References

- Chen, S. and Dodd, J. L., 1997, "Economic Value Added (EVA): An Empirical Examination Of A New Corporate Performance Measure", Journal of Managerial Issues, Vol 9, No 3, pp 318-333

- SEBI data: http://www.sebi.gov.in, last accessed on 1st January, 2009

- Chen, S. and Dodd, J. L., 1997, "Economic Value Added (EVA): An Empirical Examination Of A New Corporate Performance Measure", Journal of Managerial Issues, Vol 9, No 3, pp 318-333