Fair & Lovely : Redefining Beauty

Faculty Contributor : Avinash G. Mulky, Professor

Student Contributors : Ajay Jain, Debasish Das, Karthik Rangarajan, Praveen Singh, Sulakshana S

It is common perception that many Indian women are partial towards fairer skin. Recently, noted dermatologists commented that people are now openly asking for a solution to something that has been an obsession through the ages. Equating fairness with beauty has turned out to be a key consumer insight in the case of the fairness creams industry with Hindustan Unilever capturing nearly 53% of the market share with Fair & Lovely. The company has drawn particular scrutiny for its promotions and advertisements featuring darker skinned women turning fairer on using the cream. This article attempts to chart the typical user of a fairness cream by segmenting the market, develops a positioning statement for Fair & Lovely and makes suggestions to increase the brand potential.

Fair & Lovely: Evolution of the Brand

Hindustan Unilever's star product in the fairness creams segment had evolved into one of the most successful brands over three decades in as many distinct phases. Phase 1 saw the launch of the product in 1976 on the basic premise that "younger women wanted to have fairer skin in order to attract a better looking husband." HUL marketed this brand as a beauty cream capable of providing fairness within 8 weeks. The value proposition lucidly communicated to the consumer base read, "Get noticed by the man of your life."

During Phase 2 of Fair & Lovely's evolution, the brand talked to a younger college going woman who is self confident and more modern in her outlook and believes home remedies for facial care to be old fashioned. In Phase 3, this further metamorphosed into a brand offering emotional benefits for achievers who actively seek solutions and do not look at marriage as the ultimate source of personal achievement. Fair & Lovely thus became a brand which communicated a message that Fairness leading to Beauty leading to Good husband to Fairness leading to Self-confidence leading to Good career.2

Fairness Cream Segment

The market forces which had helped in shaping the competitive environment for Fair & Lovely include new entrants, new category introductions, increased buying power of consumers and controversies. New entrants are a regular feature in this segment of the skincare market, trying to capitalize on the same value proposition. As recently as in 2007, Nivea launched a fairness cream. Emami's Fair and Handsome created an entirely new category of products within the fairness cream range acting on the insight from consumer research that 20% of all fairness cream consumers are men. This altered the market dynamics completely, forcing Fair & Lovely as the market leader to look up and take notice. Controversies have always surrounded the fairness cream segment, with people accusing them of being regressive for promoting that fairness is beauty. These market forces have elicited certain reactions from Fair & Lovely and made the brand what it is today.

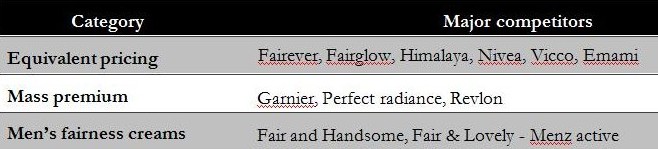

Fair & Lovely - a INR 1,000 crores brand - is the market leader in this segment having captured at least 53% of the total fairness creams market.i The competition can be best understood, if it is divided into three separate categories - Mass premium, Equivalent pricing and the Men's segment, as shown in Exhibit 1.

Exhibit 1 Fair & Lovely's competitors in the fairness creams market

Exhibit 1 Fair & Lovely's competitors in the fairness creams market

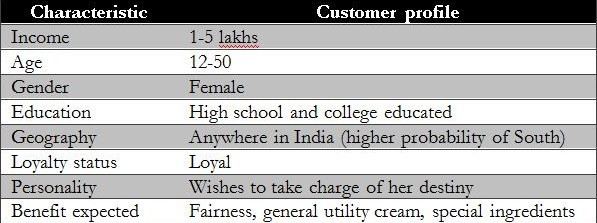

Customer Perspective: Loyalty

In order to understand the current position of the brand from a consumer's perspective, market research was conducted. An existing survey conducted on the basis of attribute-based loyalty (to understand determinant attributes which govern the customer choice, particularly when confronted with alternatives and substitutes) and secondary data gathered from reputed journals were used to understand a typical customer and chart his/her profile. In addition, a questionnaire was floated to a random sample set, eliciting opinions on the performance of Fair & Lovely and depth interviews were conducted with lead users and lost users in order to determine the ideal positioning of the brand. Based on the market research, a typical consumer has been identified and portrayed in Exhibit 2.

Exhibit 2 A typical fairness cream user

Exhibit 2 A typical fairness cream user

In general, consumers had good and bad things to say about fairness creams. They believed that fairness can be associated with confidence. But the survey results also revealed that such creams do not fulfill their claims and that fairness is not the only functional benefit that consumers are looking for in a face cream. There are many perceptions about Fair & Lovely as a brand, some of which were positive. For example, since it is the oldest fairness cream, it has become a household name particularly in the southern part of the country. But Fair & Lovely is believed to be a product for the middle class by and large and its promotion strategies are dismissed as regressive in nature. The positioning strategy of the brand becomes apparent from this exercise and it clearly equates fairness with beauty and success.

For the urban women from 17-25 years of age, Fair & Lovely offers the best path to beauty, self confidence and success among all fairness creams because it provides fairer, clearer, healthier and glowing skin in just 7 weeks.

Brand Equity

David Aaker defines brand equity as a set of assets and liabilities linked to a brand, its name and symbol that add to or subtract from the value provided by a product or service of a firm and/or to that firm's customers.3 Mapping the brand equity of Fair & Lovely using the Consumer based brand equity pyramid (CBBE)4 reveals that it has strong brand equity. Brand salience, as evaluated by the degree of "top of the mind recall" and "brand awareness" is good. Performance is based on the reliability built by the brand and the image which is defined by its heritage and its user profile, both of which are extremely high in this brand. The brand has built up credibility and a perception of quality leading to good judgments and feelings. Finally the loyal consumers of Fair & Lovely have an attitudinal attachment towards the brand, leading to high brand resonance.

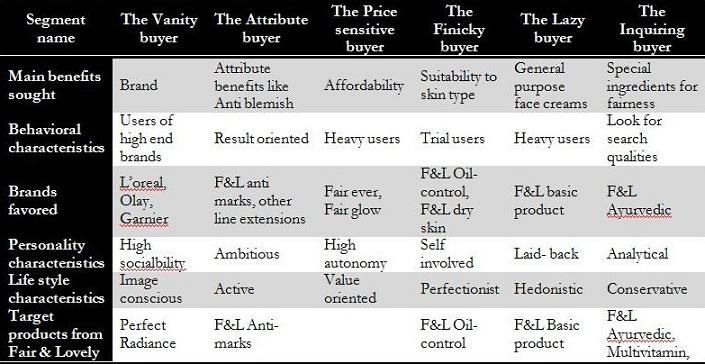

Market Segmentation and Target Groups

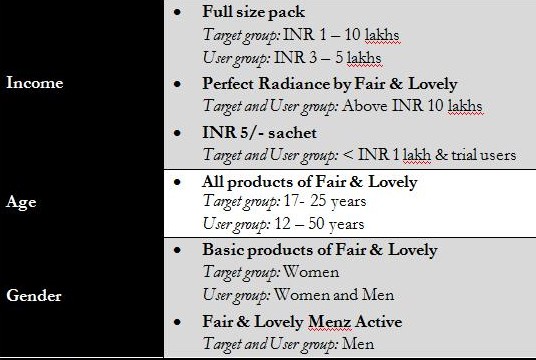

The market for the fairness creams can be divided both demographic parameters, such as income, age and occupation of the customers as well as along the behavioural axis, including differentiation on the basis of the benefits (functional, emotional and self-expressive) sought. With variation in the income of the user, the brands favoured by him/her change. As substantiated in Exhibit 3, a low to middle income customer would prefer using a brand targeted at the middle class, like Fair & Lovely, whilst the better endowed users aspire for premium products such as Perfect Radiance, by Fair & Lovely.

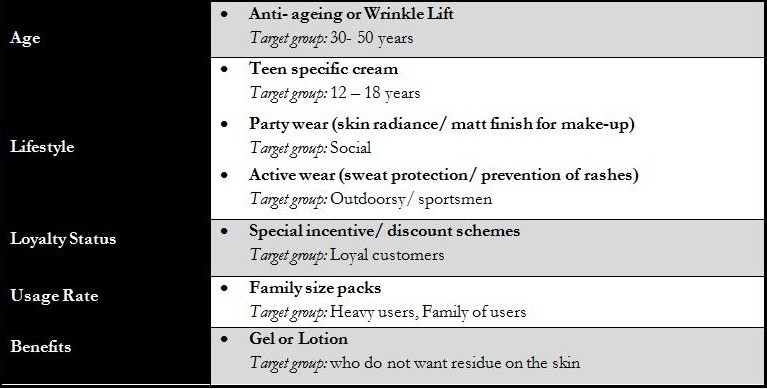

Exhibit 4 charts out those brands that customers seeking different benefits are likely to favour, whilst also mentioning the sub-brand that Fair & Lovely had introduced to cater to that segment. It divides the market into six distinct segments based on the behavioural patterns exhibited by the consumers. Some users aspire for a brand for emotional and self-expressive benefits. These customers have been surreptitiously termed as Vanity buyers. Similarly, the Price sensitive buyer is likely to rate affordability higher than other parameters while the Inquiring buyer is likely to be the early adopter of product innovations, such as the Ayurvedic or multi-vitamin skin creams.

Exhibit 3 Demographic segmentation of the fairness creams market

Exhibit 3 Demographic segmentation of the fairness creams market

Exhibit 4 Behavioural segmentation of the fairness creams market

Exhibit 4 Behavioural segmentation of the fairness creams market

Need For Change

Fair & Lovely has come a long way since 1976 when it was first introduced in India, modernizing along with its consumers. Women in the society have transformed and the brand has evolved to capture this need. Currently though, underplaying the fairness attribute may hurt the brand so the focus has to be extended and not shifted. This extension includes fairness but adds that extra something to the product as well as the brand. The addition of attributes to products would increase the perceived value for the customer which is an important objective with a mature product such as Fair & Lovely.

Though Fair & Lovely is the market leader in this segment, an erosion of its market share is always on the cards, especially since there are no significant points of difference from its competitors. The basic product needs to be re-positioned with additional attributes to increase its points of difference from the other competing brands. This revamp needs go beyond just the look of the package (which has been constantly changing) and instead, drill into the core of the brand.

Recommendations

In order to ensure the longevity of Fair & Lovely, changes in three of the 4Ps of marketing have to be initiated. The product, its price and promotion have to undergo a makeover. Such changes will inevitably necessitate a revamp of the basic model of Fair & Lovely as well as the introduction of new sub-brands to capture currently unattended segments. This can be initiated only by redefining the segments and identifying new target groups, for positioning the new sub-brands.

Exhibit 5 Changed bases of segmentation for new product introduction

Exhibit 5 Changed bases of segmentation for new product introduction

The Pledge: Vamping up the Product

A market leader must be potentially aware of flank attacks on its authority. As change becomes the name of the game, even brands like Fair & Lovely have to innovate by either changing their base product and offer new benefits to the customers or by introducing new products to capture different segments of the market.

Primary research revealed that the high-end segment of the market (graduates/post-graduates with an annual income exceeding INR 500,000) seek benefits other than fairness in a face cream. The growing number of users in this segment thereby presents an opportunity for the introduction of a new attribute that would best cater to their expectations. Apart from fairness, users look for a "tangible glow" that could be imparted to their skin after usage. Lucent protein is an ingredient which can produce immediate glow by the action of botanicals and Vitamin C esters. The package will be suitably redesigned to differentiate it from the other fairness creams which are predominantly wrapped in pink covers. The package, as depicted in Exhibit 1 must reflect a golden hue to highlight glow and sunshine, and when introduced in tandem with the old variant, it will stand out sufficiently for users to make a transformation to the new variant over the course of time.

Fair & Lovely has not exploited the potential presented by some of the segments of the market, mostly notably the ageing women population and the teens market. Depth interviews with respondents from each of these segments revealed the need for women between 30 and 50 of age to stay "wrinkle-free and young". An anti-ageing cream with wrinkle lift properties would satiate the needs of these women. Similarly, the usage of the product in the teens market was surprisingly low. Specific problems like pimples could be cured, by providing a skin cream with anti-bacterial and anti-inflammatory protection.

Exhibit 6 The revamped basic Fair & Lovely and its 2 new sub-brands

Exhibit 6 The revamped basic Fair & Lovely and its 2 new sub-brands

The Turn: New promotional programmes

With the introduction of the new variants in the market place, Fair & Lovely must focus its promotional activities in order to sell a category need, increase brand attitude and to generate the intention to purchase in the minds of the consumer. Towards that extent, TV commercials must be aimed at generating awareness and increasing brand recognition of the new products. Considering that Fair & Lovely's market share touches nearly 60% and it has a high brand recall of nearly 80% - a conservative estimate, then in order to convert at least 20% of the users exposed into customers, 9,200,000 customers have to be exposed to these commercials on prime time television. Only then can Fair & Lovely hope to achieve its targets.

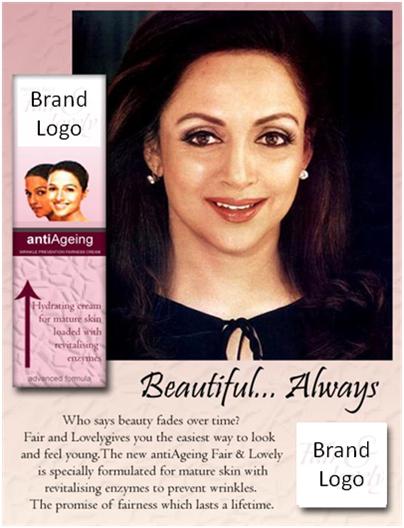

Advertisements in the print and electronic media must highlight the functional benefits and the self-expressive benefits that accrue to the users of the brand. For example, the new suggested variant Fair & Lovely Lucent Proteins must clearly highlight the concept of "beauty beyond fairness". By using a celebrity endorser like Hema Malini for promoting the anti-ageing cream, the message sent out would be loud and clear - ageing with laugh lines, and not wrinkles. Exhibit 2 shows one such sample advertisement.

Exhibit 7 New print advertisement for Fair & Lovely's anti-ageing cream

Exhibit 7 New print advertisement for Fair & Lovely's anti-ageing cream

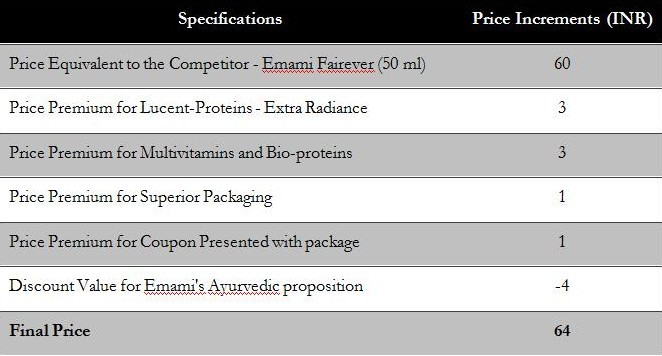

The Prestige: Pricing Competitively

An organization's costs would set a floor to the price, however, that is not the basis for actually setting a final price to the product. Competitor's prices and the price of substitute products like provide a reference floor, for starters. The customers' assessment of the product's unique features establishes the price ceiling. Therefore, in order to evaluate the final price, the recommended strategy would be to base the price on the customer's perceived value from the product. For a 50 ml package, competitive advantage could be sustained if priced at INR 64, as explained below.

Exhibit 8 Perceived value pricing strategy for Fair & Lovely

Exhibit 8 Perceived value pricing strategy for Fair & Lovely

Conclusions

Today Fair & Lovely is the market leader with 53% market share but in the era of increasing competition, erosion of market share is more a reality than mere speculation. With products like Emami's Fair and Handsome hitting out unexpectedly, Fair & Lovely should be proactive and increase the points of difference with its competitors. Moving beyond the message of fairness as beauty must be the center of its marketing communication. The recommendations provided would do just that, extending the core message of the brand through to the product and communicating it by various promotional strategies. In fact, this is where the next INR 1,000 Crores are most likely to come from.

Authors

Prof. Avinash G. Mulky is the Chairperson of the Marketing area at the Indian Institute of Management, Bangalore. He holds a Ph.D. from IIT, Bombay and a Post Graduate Diploma from IIM, Ahmedabad. He can be reached at avinashgm@iimb.ernet.in.

Ajay Jain (PGP 2008-10) holds a Bachelor's degree in Electronics & Communications Engineering from the Indian Institute of Technology (IIT), Delhi. He can be reached at ajay.jain08@iimb.ernet.in.

Debasish Das (PGP 2008-10) holds a Bachelor's degree in Computer Science & Engineering from Kalinga Institute of Industrial Technology (KIIT), Bhubaneswar. He can be reached at debasish.das08@iimb.ernet.in.

Karthik Rangarajan (PGP 2008-10) holds a Bachelor's degree in Electronics & Instrumentation from the Biral Institute of Technology & Science (BITS), Pilani. He can be reached at karthik.rangarajan08@iimb.ernet.in.

Praveen Singh (PGP 2008-10) holds a Master's and Bachelor's degree in Mechanical Engineering from Indian Institute of Technology (IIT) Bombay. He can be reached at praveens08@iimb.ernet.in.

Sulakshana S (PGP 2008-10) holds a Bachelors degree in Fashion Technology (Textile design) from National institute of Fashion Technology (NIFT) Hyderabad. She can be reached at sulakshanas08@iimb.erent.in.

Keywords

Hindustan Unilever, Fair & Lovely, brand equity, segmentation, targeting, positioning, promotion

References

- Challapalli, Sravanthi, "All's fair in this market", The Hindu Business Line, http://www.thehindubusinessline.com/catalyst/2002/09/05/stories/2002090500040300.htm, September 2002, last accessed on: 6th October, 2009

- "Fair & Lovely", http://www.fairandlovely.in, last accessed on: 6th October, 2002

- Aaker, David, 1991, "Managing Brand Equity", Simon & Schuster, pp: 15

- Keller, Kevin Lane and Moorthi, YLR, 2002, "Karma cola- Coke in India", Working paper no. 186, IIM Bangalore