Thai Economy: Effect of US Slowdown

Faculty Contributor : Rupa Chanda, Professor

Student Contributors : Parvathi Nair L., Pomil Katoch

The US economy is currently undergoing a recession. The general perception is that the rate of growth of the emerging economies is linked with the rate of growth of the developed economies. But the question is whether this will hold true in the current scenario where other economies like China are emerging as economic superpowers. This article investigates this issue by studying the effect of US recession on the Thai economy.

"For the past hundred years, the rate of growth of output in the developing world has depended on the rate of growth of output in the developed world. When the developed grow fast, the developing grows fast, and when the developed slow down, the developing slows down. Is this linkage inevitable?"

~ Sir Arthur Lewis, 1979 (Nobel Prize Lecture)

Thai Economy is characterized by a period of high growth from 1986-1991, with an average growth rate of 10.3% followed by a period of crisis from 1996- 1998 during which the export growth of Thailand became zero and the GDP growth became negative. Thailand recovered from the crisis and this recovery was led by the manufacturing sector. USA is one of its major trading partners of Thailand and Thailand being an open economy is vulnerable to the fluctuations in external demand. Moreover USA is one of the top investors in Thailand. Thus, Thai economy has a great dependence on the US economy. Thus the linkages between the US economy and the Thai economy, and the effect of the recession, in particular, make for an interesting study.

The Thai Economy

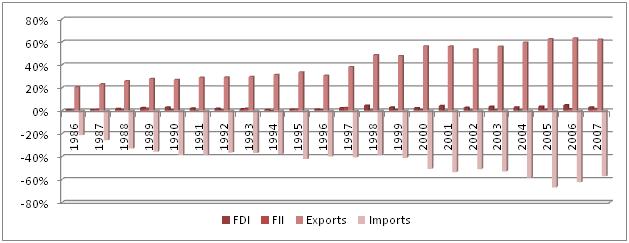

Exhibit 1.

Thailand's international transactions pattern (% of GDP)

Exhibit 1 shows that exports and imports as a percentage of GDP are much higher as compared to FDI and FII implying that trade is more important driver of growth for Thai economy. This is evident from the fact that the share of trade in Thailand's GDP has increased steadily over the past several years to reach a high of about 140% with exports accounting for about 75%.1

Further analysis done by regressing the natural log of Thailand's real GDP with natural log of other independent variables: Thailand's real exports, real imports, FDI into Thailand, and FII into Thailand revealed that exports are the most important driver of growth for Thailand as the coefficient of exports came out to be the highest compared to the other variables. Granger causality test, which measures the causality between two factors, conducted between Thailand's real GDP and Thailand's exports revealed that the exports are a cause of GDP growth in the case of Thailand.

Major Trade Partners

Having establishing that trade is the most important driver in case of Thailand, the next step was to see how the trade relations of Thailand with the major trading partners such as the US, EU, Japan, ASEAN and China have been changing over the years.

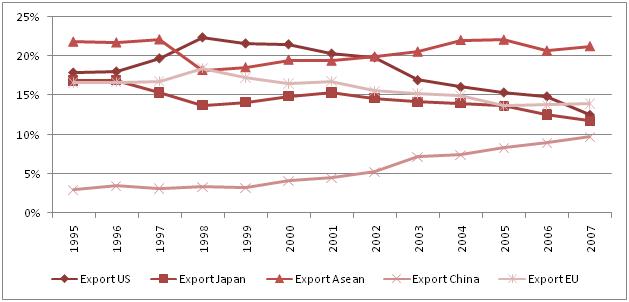

Exhibit 2.

Thailand - Country-wise Real Exports share (%) to major export destinations

Though a time-series-regression between the Thai-GDP and exports to each destination showed that exports to the US, EU, and Japan has driven the Thai growth the most, but from Exhibit 2 it can be observed that the percentage share of exports these countries has decreased with time. The percentage share of exports to ASEAN has remained almost constant and the percentage share to China has increased over time. "Thai producers have come under pressure from sluggish domestic demand and a slowdown in exports to the US to push harder in new markets, and seem to have been aided by Thailand's free trade agreements." Some of the developments in Thailand which helped it to divert the trade to destinations other than US, EU and Japan are given below:2,3,4

-

Thailand became a member of the World Trade Organization (WTO), the Cairns Group of agricultural exporters, and also a part of the ASEAN Free Trade Area (AFTA).

-

Thailand has got into many free trade agreements. A China-Thailand Free Trade Agreement (FTA) commenced in October 2003. This agreement was limited to agricultural products, with a more comprehensive FTA to be agreed upon by 2010.

-

A limited Free Trade Agreement with India was commenced in 2003.

-

A comprehensive Australia-Thailand Free Trade Agreement was started on 1 January 2005. For example, exports of automobiles and parts to Australia surged after this bilateral agreement.

Dependence of Import Growth on GDP Growth for the US and China

As the major portion of export decrease to the US was being taken up by increase in exports to China, the next step was to study if the slowing down of the US economy and the booming of the Chinese economy would significantly affect the growth of exports from Thailand to these respective economies. For this the dependence of import growth of these economies on their GDP growth was studied.

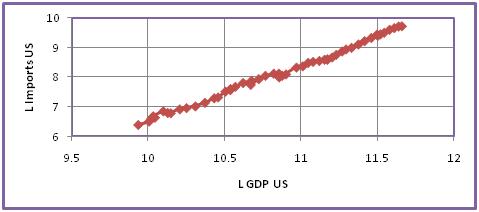

Exhibit 3.

Scatter Plot: Log of US Real GDP v/s Log of US Real Imports

Exhibit 3 shows that when the GDP of the US increases the imports to US also increase. Thus it could be concluded that in the case of the US, the GDP growth will promote growth in imports. So the GDP growth of the US will have an effect on the exports coming to the US from other countries which is justified by the fact that the exports from Thailand showed a decrease in 2001 when there was an US slowdown.

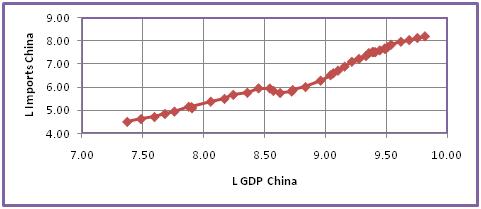

Exhibit 4.

Scatter Plot: Log of China Real GDP v/s Log of China Real Imports

Exhibit 4 again illustrates that when the GDP of China increases the imports to China also increase. Thus in the case of China, the GDP growth promotes import growth. So the GDP growth of China will have an effect on the exports coming to China from other countries which corroborates the fact that the share of exports from Thailand to China is now increasing.

Role of FDI in Thailand

FDI is important for a country like Thailand although the direct effect of FDI growth on Thailand's GDP growth is insignificant. The FDI growth has an indirect effect on export and hence an indirect effect on Thailand's GDP growth since Thailand is an export-led economy. Some researchers have proved that FDI inflows might stimulate economic growth of a country from the perspective of technology transfer and spillover efficiency. This is due to the absorption of tangible and intangible assets of Multi-National Corporations (MNC) by the domestic firms. In addition, the forward and backward FDI linkages and the role of MNC in providing technical assistance to the domestic firms also contribute to increasing of the technology and productivity level.

Thus it is important to study the sources of origin of FDI and also about the destination sectors. The FDI coming to Thailand from US has reduced in the recent years. Instead, China is emerging as an FDI partner of Thailand. China's policy towards FDI has recently changed from emphasizing the attraction of FDI to encouraging Chinese firms to invest overseas. Presumably the biggest recipient of Chinese FDI in ASEAN has been Thailand. In September 2003 there were 242 mainland companies with operations in Thailand. Future Chinese investments in Thailand are bound to be influenced by this China-ASEAN Free Trade Agreement (CAFTA), which was signed on December 2, 2004 and will take affect by 2010.

Current Status of the Thai Economy

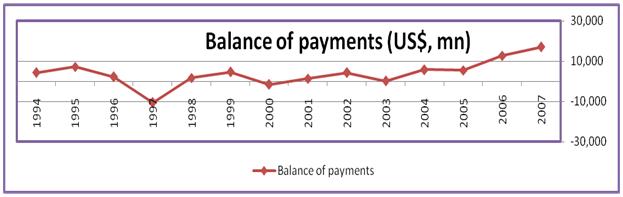

In order to analyze the current health of the economy the balance of payment position of Thai economy was plotted over the years (see Exhibit 55).

Exhibit 5.

Thailand: Balance of Payment

It can be seen that in 1997, the year when the Asian crisis happened, the balance of payment of Thailand was negative. The deficit in the current account balance was because till 1997 the imports were more than the exports and thus there was a deficit in the trade balance. In 1997 the balance of payment position of Thailand had become negative because there was a net capital outflow in addition to the deficit in the current account balance. After 1997 it can be seen that exports became more than imports and that the inflow of capital was coming mainly through FDI.

In 2007, there was an increase in exports in spite of the slowing down of the US economy and appreciation of the baht. The imports also increased but this increase is not significant enough to drive the trade balance negative. There was a positive flow of net services income and thus the current account balance was positive. In 2007, there was suddenly a significant outflow of capital in terms of FII which drove the capital account balance negative. The net capital inflow in terms of FDI also reduced in 2007. This was in contrast to the increase in the inflow of capital in terms of FII and FDI in 2006. The most interesting point is that in spite of there being a net outflow of capital the balance of payment position in 2007 was more positive than that in 2006. This shows that in the present scenario trade is much more important to the Thai economy as compared to capital inflow and within trade, exports are more important than imports. Overall the Thai economy is in good health and seems to be sustainable even when the US economy is on a slowdown.

Conclusions

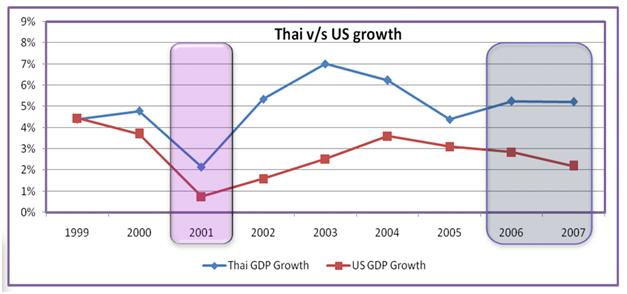

Thus from the facts that the ASEAN is having greater FII share in Thailand compared to the US; the US share of Thai exports has been declining steadily from about 20% just prior to the financial debacle of 1997-98 to slightly above 10%; Chinese share of Thai exports has jumped from 3.1% to about 10% today; and that Thailand's exports to US amount to only about 9% of its GDP as compared to about 20% for Singapore, Malaysia, and Hong Kong, it can be concluded that Thailand is decoupling from the US. It is even more evident from the graph below (Exhibit 6) which shows an increase in Thai growth while US growth is on decline since 2006.

Exhibit 6.

Thai growth vis-a-vis US growth

Now the question that remains is that as we have seen in the case of Thailand are the other emerging economies decoupling from the US in the wake of the US slowdown. Some of the observations in this regard are that the total trade of the emerging economies with the industrial countries has decreased from 70% to 50%, exports to the US as a percentage of GDP is becoming miniscule in many of these emerging economies (China -8%, India - 4%, Brazil - 3%, Russia - 1%); trade share to US of many of these emerging economies is retreating (India's export share to the US has decreased from 22.8% to 17% since 2000, India's import share to US has decreased from 7.15% to 6% since 2000); share of exports to China of many of these emerging economies has increased from 2000 to 2007 (Taiwan: 3% to 24%; South Korea: 11% to 22%; Hong Kong: 34% to 49%; India: 5 times increase; Philippines: 3 times increase) and that the intra-regional trade has increased (14.7% of total exports and 14.4% of total imports of Singapore are with Malaysia; Japan is Taiwan's second largest trading partner with 21% of total trade). Thus, other emerging economies also seem to be on the path of decoupling from the US.

Contributors

Rupa Chanda is a Professor in the Economics & Social Science Area at IIM Bangalore. She holds a Ph.D. in International Trade, Macroeconomics from Columbia University and a Bachelors degree in Arts from Harvard University. She can be reached at rupa@iimb.ernet.in

Pomil Katoch (PGP 2007-09) holds a B.Tech. in Electronics and Communication from National Institute of Technology, Hamirpur. He can be reached at pomilc07@iimb.ernet.in

Parvathi Nair L. (PGP 2007-09) holds a B.Tech. in Applied Electronics from College of Engineering, Trivandrum. She can be reached at parvathin07@iimb.ernet.in

Keywords

Economics, Econometrics, Thailand, USA, ASEAN, Coupling, Decoupling

References

-

Suphachai Sophastienphong, 2008, How vulnerable is the Thai economy to a US recession?, http://www.bangkokpost.com/010808_Business/01Aug2008_biz41.php, August 1, 2008. Last accessed on August 19, 2008.

-

Asian Development Bank, http://www.adb.org/documents/books/ado/2008/THA.asp. Last accessed on August 19, 2008.

-

Wikipedia - Economy of Thailand, http://en.wikipedia.org/wiki/Economy_of_Thailand. Last accessed on August 19, 2008.

-

The Importance of Thailand and Vietnam Cooperationa and Collaboration, Asia Finest Discussion Forum, http://www.asiafinest.com/forum/lofiversion/index.php/t85161.html. Last accessed on August 19, 2008.

-

Puah, Chin-Hong, Kueh, Jerome Swee-Hui, and Lau, Evan, 2007, The Implications of Emergence of China Towards Asean-5: FDI-GDP Perspective, August 20, 2007.