Indian Cement Industry: Can UltraTech be the next Market Leader?

Student Contributors:Arjun R Kannan, Debabrata Ghosh, Manaw Mohan, Priyank Dutt Dwivedi, Rahul Raj Jain

This article analyzes UltraTech's present position in the market and its strategies to enhance its presence in the cement industry. An industry analysis followed by the resource based view of UltraTech highlights UltraTech's strengths and areas of improvement. Thereafter, a financial comparison of UltraTech with its main competitor ACC provides an insight into its cost structure. Through in depth analysis, this article seeks to provide specific recommendations on what UltraTech must do in order to achieve market leadership.

Cement demand in India has increased due to the increasing expenditure by the Indian government in infrastructure. As a result, the participation of larger companies in the sector has also increased. There are a total of 125 large cement plants and more than 300 small cement plants operating in the country presently. The cement industry is a homogenous industry with similar nature of raw materials, rising power costs, similar manufacturing and processing units. The nature of the product makes it difficult for any player to differentiate in order to corner a large share of the market. This leads to low margins and makes the industry unattractive.

On 17 June 2003, the Aditya Birla Group (ABG) acquired management control of L&T Cement and renamed it UltraTech. The acquisition brought in new competitive dynamics. The company has since grown rapidly. It is currently the second largest cement producer and is third in terms of profitability.

The Cement Industry1

The cement industry is an interesting one to analyze as on one hand the similarity of raw materials and processing units makes differentiation difficult, while on the other hand large companies are acquiring smaller ones, changing industry dynamics.

Competitors: The Indian cement industry has a large number of fragmented firms. There is also a dearth of new players as incumbents have already procured key raw material sources, like limestone reserves on long-term leases. Further, large firms are continuously consolidating by acquiring smaller ones that find it difficult to attain minimum efficient scale of production.

Product: Cement is a bulk commodity and a low value product. It is sold in 50 kg packs as OPC grade 33, 43, and 53. It is used in all construction activities as a primary constituent of concrete. Due to similar raw material inputs and production processes, there is no significant differentiation in the cement produced across firms.

Environmental Issues: Greenhouse gas emissions from cement manufacturing pose a serious environmental threat. Currently, the cement industry generates 5% of India's total carbon-dioxide emissions.2 With stringent emission norms, the production process needs to be made environmentally sustainable. The cost of implementing new production processes that help reduce emissions can be offset by trading certified emission reductions (CERs). CERs are a component of national and international emissions trading schemes, implemented through Clean Development Mechanism (CDM) projects, in an attempt to mitigate global warming.3 Credits obtained through implementation of such projects can be traded in international markets.

Having studied the cement industry and identified the main issues facing the firms, we engage in an in depth analysis of the firm's resources to identify the sources of sustainable competitive advantage

UltraTech's Sources of Competitive Advantage4,5

The key players in the cement market are Holcim Group, Lafarge Group, ACC and J K Cement. ABG that possessed the Grasim cement unit acquired management control of L&T cement in the year 2003. The acquisition of L&T Cement (later named as UltraTech) turned the group into one of the largest players in the market.

Value chain analysis helps in identifying sources of competitive advantage in a systematic manner, and thus we use this framework. The cement industry value chain comprises (1) sourcing of raw materials and fuel from quarries and mines (2) the manufacturing process, and (3) distribution of the product to the markets.

The sources of competitive advantage identified for UltraTech are:

UltraTech's capabilities in identifying, and leasing, higher quality raw material quarries results in significant cost savings for them.

Sourcing of Raw Materials: UltraTech's greatest strength is its raw material sourcing. Limestone quarries are usually leased from the government on a long-term basis (usually at least 25-30 years). UltraTech's capabilities in identifying, and leasing, higher quality raw material quarries results in significant cost savings for them. This source of long-term competitive advantage is due to their people skills which aid in identifying the sources and their terms of leasing which lock in these resources for the long term. Clearly, this resource is valuable and rare.

Fuel used in Manufacturing Process: The manufacturing process offers no distinct competitive advantage to UltraTech or its largest competitor ACC, though ACC enjoys lower fuel cost. However, this is not sustainable, and since UltraTech has already started switching to coal, ACC's advantage is likely to be neutralized in the near future.

Financial and Human resource advantage: UltraTech, being a part of the Aditya Birla Group, has access to the deep pockets of its promoters, as well as human capital of the highest quality. While financial resources may be rare and inimitable, non-substitutability is debatable. Evidence suggests that in the long term others like the Holcim group can match the financial resources of ABG.6 Higher quality of human capital might be more valuable in the long run, and given their astute knowledge of the Indian market, ABG might be able to leverage this resource better than their foreign counterparts.

A final point to note is that UltraTech has higher operating leverage than ACC. This by itself is neither a source of competitive advantage nor a disadvantage. In the long run, the gains during the 'up' years will be smoothened by the 'down' years of the cement cycle.

UltraTech V/s ACC - A Financial Analysis7,8

The objective of this financial analysis is to identify specific advantages enjoyed by UltraTech vis-a-vis its major competitor ACC, their relative magnitude and sustainability.

The last few years of this decade have been good for cement companies as prices have remained high, and hence profits have been good.9 In the same period, UltraTech and ACC have shown the same trends of increasing sales growth and capacity utilization although UltraTech has done marginally better, and succeeded in closing the gap with its rival.

In a post-mature industry such as cements, first movers' advantage in terms of differentiated products is easily negated thereby necessitating the need for Ultratech to establish itself as a cost leader.

The cement industry is a "post-mature" industry - an old industry where change is slow and marginal, first movers' advantage in terms of differentiated products is minimal and any advantage is likely to be fleeting and parity would be restored soon enough. In such an industry, the only way for UltraTech to be the number one is to be a cost leader. Thus, it is imperative to analyze the cost advantages, which ACC and UltraTech have relative to the each other.

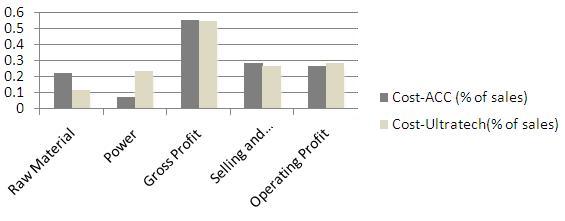

A detailed analysis of the cost structure (Exhibit 1) reveals stark differences between ACC and UltraTech in raw material and power costs. A comparison of raw material costs showed that UltraTech had a huge advantage (nearly double) over ACC due to greater access to better quality quarries. For the same quantity of cement produced, UltraTech spent less on mining, and got better quality limestone, than ACC.

A comparison of power costs revealed a different picture with ACC enjoying a cost advantage over UltraTech. This is due to the higher cost of Naphtha and Fuel Oil based Power Plants used by UltraTech (in addition to coal fired plants) while ACC used only coal based plants. UltraTech wanted to spread the risks of prices and availability of fuel, but the strategy backfired as coal remained a much cheaper alternative (detailed cost breakups shown in Exhibit 1).

Exhibit 1 Comparison of costs between ACC and UltraTech

Exhibit 1 Comparison of costs between ACC and UltraTech

UltraTech - Looking Ahead

We look at the trends emerging in this sector and analyze how UltraTech can leverage these to its advantage in the light of its competitive advantages.

Cost leadership: Striving to become a cost leader by means of setting up captive power plants, and/or up-gradation of technology to enhance productivity, is increasingly becoming critical for large cement players in this sector.

Rising Exports: Due to the increasing construction activity in the Middle-East, exports will constitute a major sales driver. Hence, the coming years would see companies scrambling for bases on the Western coast to minimize their export transportation costs.

Retail Stores: A unique concept, which Ultra Tech is experimenting with in recent times, and one that is important for the future, is to continue setting up retail stores. Other companies like Asian paints, and most recently Tata Steel have tried a similar concept.

Relationship Management: UltraTech should focus on managing its relationships with importers, exporters, distributors, warehouse providers, wholesalers, retailers and dealers for their long-term profitability.

Synergies with Grasim: The two companies under the ABG banner can exploit operational synergies in raw materials procurement, manufacturing, common branding, dealer networking, logistics, and exchange of key personnel.

Ready Mix Concrete: Finally, one of the recent trends in this sector is the focus on ready-mix concrete. Therefore, an early technology and capacity building in this area would determine the strategic moves of cement companies in the future.

Conclusion

This article has succinctly analyzed the present state of affairs at UltraTech cement and thus identified its strengths and problem areas through a variety of tools. While its raw material sourcing, financial and human resource pools are sources of competitive advantage, UltraTech has to improve in terms of fuel costs in order to beat ACC to the top position in the low margin industry. This can also be achieved by leveraging futuristic trends like branded retailing, exports and new products like ready concrete mix.

Authors

Arjun R Kannan (PGP 2007-09) holds a B. Tech. in Chemical Engineering from Indian Institute of Technology (IIT) Madras. He can be reached at arjunk07@iimb.ernet.in

Debabrata Ghosh (FPM 2007) holds a B. Tech. in Mechanical Engineering from Vellore Institute of Technology and has previously worked at TCS, Bangalore. He can be reached at debabratag07@iimb.ernet.in

Manaw Mohan (PGP 2007-09) holds a B. Tech. in Chemical Engineering from Indian Institute of Technology (IIT) Chennai and has previously worked at ITC Ltd. He can be reached at manawm07@iimb.ernet.in

Priyank Dutt Dwivedi (PGP 2006) a B. Tech. He can be reached at priyankd06@iimb.ernet.in priyankd06@iimb.ernet.in

Rahul Raj Jain (PGP 2007-09) holds a B. Tech. in Civil Engineering from Indian Institute of Technology (IIT) Kanpur. He can be reached at rahulj07@iimb.ernet.in

This article is drafted from the student project done under the guidance of Prof.Rejie George Palathitta ,Assistant Professor in the Corporate Strategy & Policy Area at IIM Bangalore.

Keywords

Strategy, Cement, India, UltraTech, ACC, Aditya Birla Group, ABG

References

- Report by ICRA Ltd, Publications titled "The Indian Cement Industry", Published March 2008

- http://indiatoday.digitaltoday.in/content_mail.php?option=com_content&name=print&id=1814

- http://www.cogeneration.net/certified_emission_reduction.htm

- Company analysis report by Research arm of ENAM Securities Pvt. Ltd. Company : Grasim, Published in March 2008

- Company analysis report by Research arm of SSKI India Research, Published 5th April, 2007

- Economic Times, 3rd Feb 2008, "Holcim to invest Rs 10,000 cr in five years in cement sector", http://tinyurl.com/ydtx33l, Last accessed on March 10th, 2008

- Business Standard, 8th February 2006, "Cement industry in India is on strong foundation" http://www.ibef.org/artdisplay.aspx?cat_id=528&art_id=9722 Last accessed on April 25th, 2008

- Abhinaba Das, Economic Times, July 2005, "Cement demand in south up 22% in Q1", http://findarticles.com/p/articles/mi_hb5936/is_200507/ai_n23943409 Last accessed on June 25th, 2008

- Economic Times, 16th March 2008, "Cement prices to remain firm in medium-term: CMIE" http://economictimes.indiatimes.com/News_by_Industry/Cement_prices_to_remain_firm_in_mediumterm _CMIE /articleshow/2870707.cms, Last accessed on April 15th, 2008