Indian Energy Drinks - Time To Go Organic?

Student Contributors : Amar Deep Singh, Chander Prakash, Irshad Ahmed M A, Niharika Bhatnagar, Sachin G and Swati Murarka

The energy drinks market in India, though still in its infancy, is expected to grow at a CAGR of 25%. In the last few years, energy drinks have faced increasing health concerns due to their high caffeine content. The food regulator (Food Safety and Standards Authority of India) is considering stripping them of the ‘energy' tag and of regulating the caffeine content. In international markets, organic energy drinks are offered for health conscious consumers. However, no such prominent product is available in India. Seeing this gap, we looked to address the following:

1.Opportunities for organic energy drinks in India

2.Conceptualization of an organic energy drink (specifically, an organic variant of Red Bull, labeled Red Bull Natural) for Indian markets

The methodology was primary and secondary market research. Primary market study was through surveys to understand the needs and wants of consumers that the existing energy drinks are unable to meet, consumer expectations and the extent to which they are met by the new product launch. Secondary market research was taken up to collect relevant market data through research reports, media reports and articles for understanding the evolution of the Indian energy drink segment, industry structure, various products available, consumer preferences and perceptions.

The current energy drinks market in India is around Rs 500crores. In 2010, the total consumption of energy drinks stood at around 1.5 million cases of 24 cans. Awareness among consumers is on the rise. India's impressive economic growth has pumped in enormous sums of money into the middle and upper class households. This has resulted in a substantial increase in lifestyle expenses. Energy drinks have become an urban phenomenon.

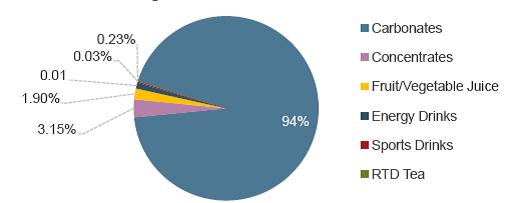

Exhibit 1 Market share of various categories of soft drinks in India in 2011

Exhibit 1 Market share of various categories of soft drinks in India in 2011

In the last few years, energy drinks have faced increasing health concerns globally due to their high caffeine content. A growing emphasis on health coupled with improved disposable incomes has led to a growing preference for natural alternatives of energy drinks. Growth in organic food industry can be used as an indicator to study shift in consumer preferences. Indian organic food market is growing at an annual rate of 40%. According to ASSOCHAM, organic farming in India is likely to be worth Rs 10,000crores by 2015 from the current levels of about Rs 2,500crores. As per a survey conducted by ACNielsen, India is among the top ten countries where health food, including organic food, is demanded by consumers. An organic energy drink seems to have the potential to satisfy the unmet health needs of the consumers and at the same time offer the benefits of a typical energy drink.

What Should Red Bull Natural Look Like?

The concept of Red Bull Natural is a combination of features that address the stated and latent needs of consumers. Red Bull Natural would be based on Red Bull's formula of providing the much-needed spurt of energy in everyday stressful life. It would provide the same performance benefits of increased energy, increased concentration, increased reaction speed, improved mental alertness and increased metabolism, as Red Bull, the highly successful energy drink, but with more health benefits than Red Bull.

Apart from being an instant energy drink, Red Bull Natural will be a product prepared using only natural ingredients to address the need of those who demand a ‘health factor’ in energy drinks and also introduce the drink to those who are opposed to energy drinks due to ‘adverse health effect’ concerns. The natural ingredients could include the following:

- Raw Brazilian coffee seed to replace caffeine; good for better body metabolism

- Ginseng, the roots of which are consumed to enhance body’s resistance to stress

- Brazilian guarana for improved physical and mental endurance

- Elderberry juice which contains anti-aging anti-oxidants and other natural extracts

- Natural crystal sugar

- Natural fruit juice for flavour

It could be lightly carbonated to ensure that there is not too much fizz to spoil the refreshing experience of energy while still retaining the fun of a light beverage. Adding more to the drink, it could be fortified with a shot of Vitamin-B to provide that extra special kick with all-natural energy.

It’ll be ideal to launch the drink in multiple flavours, using natural fruit extracts and without any artificial preservatives to cater to different individual tastes. Each and every product attribute such as packaging type and size, drink colour, taste and scent would be conceptualised in line with Generation Y’s stylish attitude together with the health benefits to consumers.

Whom Will Red Bull Natural Sell To?

Now that the concept of Red Bull Natural has been laid out in barebones, let us look in to where exactly we can place such a product in the current Indian market. To identify a particular market space for our new product, we shall adopt a three step process. This would help us in ‘segmenting’ the entire customer base of energy drinks based on different characteristics be it age, gender, income, lifestyle, place of residence and so on. Subsequently, we will be ‘targeting’ a certain group or groups who would not only make us happy with their affiliation towards Red Bull Natural but also enable us to give our best in serving them with our best product yet! After identifying the target, all our efforts would be simply on ‘positioning’ our product as the best possible choice for the consumer. Now, let us explain the three divvies that will help Red Bull’s newcomer to acquire as large a market pie as possible.

Segmentation of the customer base

1. Based on Geography

If you consider many different landscapes of our country, vast majority of the demand for energy drinks pours in from the concrete jungles of Metropolis, Tier I and Tier II cities where most people lead a fast, hectic and stressful life and are in need for constant energy. Above the natural need for energy there is also an underlying need for a style statement that munches on a small part of our market pie. Hence, it is only ideal Red Bull Natural would place itself at urban areas with major sightings of it being in modern retail stores such as super markets, hypermarkets and so on. Local Kirana (Mom & Pop) store is not an ideal place, mainly because of the risk that would bring of wiping out the premium tag that Red Bull has proudly carried out throughout its life cycle in India.

2. Age and Gender

The Red Bull brand has always concentrated on the image of young, risk-taking go getters which is all too obvious and well represented in ads of Red Bull. Hence, students and young executives who are in need of constant energy to toil and endure sleepless nights would be our main customer base. To put it in plain numbers, 20 to 35 years of age has been a ripe market for the majority of energy drinks in the market today. Historically, energy drinks had appealed only to the male segment. However, our aim is to make history with this unique product, hence the female counterparts would be regarded as equal contenders to grab every Red Bull Natural out on the stands.

3. Income & Frequency of Energy dosage

When it comes to income of the consumer base, although Red Bull is considered a premium brand, at least in India, we would not say that it is exclusively for someone with deep pockets. At the end of the day, an energy drink represents a refreshing beverage that promises instant energy and hence is never out of reach for the Indian middle class.

Based on the how often one is in need of instant energy, two major groups of consumer base can be identified - light users and heavy users. Heavy users are the ones who are more prone to exhaust themselves in an effort to push the limits of human capacity in order to achieve the unachievable. This would certainly require a sip of Red Bull more than once in a work week. And we are glad to make the experience all the better with Red Bull Natural.

Consumer Targeting

Based on our previous attempt of slicing the market pie into various categories, we shall now try to take aim for a specific creamy part that will indulge in our offering.

From our early analysis of the individuals in the market, we can conclusively point towards the group who will be consistent sippers of Red Bull Natural. And someone who would be at the top of our Red Bull Natural promotional offering:

- Individuals living in urban areas – Metros, Tier I & Tier II cities

- Both genders would be targeted equally since we believe that female individuals cannot possibly resist our offering once the brand goes organic

- To cater to the different consumption capacities of individuals, the product would be introduced in two sizes

Positioning of Red Bull Natural

Red Bull Natural will be aimed at health conscious minds who want energy and benefits of an energy drink without any of its adverse effects. In line with popular consumer perception of the sample survey, Red Bull Natural will be positioned as an organic drink with natural extracts and no added artificial flavours. Our offering aims to occupy the minds of consumers as a source of instant energy and wellness. This would tap the existing market space unoccupied by energy drinks due to concerns around health issues associated with energy drinks.

Conclusion

While the survey looked at the consumer base in a few geographical areas and the competitive landscape of the energy drink segment would have changed during the course of study, the consumer base was majorly the urban youth and it can be taken to be representative of the entire energy drink consumer segment. Through consumer surveys conducted, it was seen that a product such as Red Bull Natural would fill a gap in the Indian energy drink market and will be able to establish itself if made to appeal to the right consumer group.

Keywords

Product Conceptualization, FMCG, Energy Drink, Organic, Red Bull, Health

Contributors

Amar Deep Singh (PGP 2011-13) holds a B. Tech. from Indian Institute of Technology, Kanpur. He can be reached at amar.singh@iimb.ernet.in.

Chander Prakash (PGP 2011-13) holds a B. Tech. from College of Technology & Engineering, Udaipur. He can be reached at chander.prakash@iimb.ernet.in.

Irshad Ahamed M A (PGP 2011-13) holds a B. Tech. from National Institute of Technology, Trichy. He can be reached at irshad.ahamed@iimb.ernet.in.

Niharika Bhatnagar (PGP 2011-13) holds a B. Tech. from Indian Institute of Technology, Kanpur. She can be reached at niharika.bhatnagar@iimb.ernet.in.

Sachin G (PGP 2011-13) holds a B.B.M. from St. Joseph's College of Commerce, Bangalore. He can be reached at sachin.g@iimb.ernet.in.

Swati Murarka (PGP 2011-13) holds a B. E.(Hons.) from Birla Institute Of Technology & Science, Pilani. She can be reached at swati.murarka@iimb.ernet.in.

Acknowledgement

The student contributors would like to thank Dr. Nagasimha Balakrishna Kanagal,Associate Professor in the Marketing Department of Indian Institute of Management, Bangalore, for his guidance in their work. He can be reached at kanagal@iimb.ernet.in.

References

-

Business Standard, http://www.business-standard.com/india/news/kit-non-alcoholic-beverage-market-in-india/452713. Last accessed on Dec 5, 2011.

-

Dinesh C Sharma, http://indiatoday.intoday.in/story/crackdown-on-energy-drinks-soon/1/202228.html. Last accessed on Dec 5, 2011.

-

Amit Khanna, http://www.business-standard.com/india/news/red-bull-to-bankf1-to-beefbrand-equity/147952/. Last accessed on Dec 5, 2011.

-

"Flavours in Soft Drinks in India", Euromonitor International

-

Editorial Team (India Microfinance), http://indiamicrofinance.com/organic-farming-india-2015.html. Last accessed on Dec 5, 2011.

-

A C Nielsen, http://www.acnielsen.co.in/news/20060220.shtml#Table10. Last accessed on Dec 5, 2011.