Fighting Perceptions: Dilemma of a Face wash Brand

Student Contributors : Abhik Saha, Adeeba Ansari, Arvind Duray, G Krishna Kumar, Ishan Gaikwad, Jagaveera Ramkumar U and Jayat Ghosh

This article aims to develop a sales promotion plan for a brand in the category of face wash while taking into account the brand associations of the respective brand, by appealing to consumers who use soap. It aligns different theories and frameworks of consumer behavior together to develop a sales promotion plan, and in the process gives some insights into the nature of the face wash category. The concept of consumer behavior around which the entire article revolves is “perception”. It details the relation and impact of sales promotion strategies on the perception of consumers.

The Indian skincare industry consists of various categories such as body care, depilatories, facial care, hand care, makeup remover and sun care. Facial care is a very lucrative market that generates nearly 58% of the market’s overall value and has a CAGR of 4.1%. Face cleansers account for nearly 26% of the facial care market. Face cleansers include facial foams, scrubs and face washes, but they are all different from each other based on price. In India, several face wash brands are present and they offer a variety of benefits. Brands like Dove, Pears have both soap and face wash products whereas brands like Ponds, Lakme have a face wash and not soap in their product portfolio in skin care category. The acceptance level of this product is moderate in urban and low in rural areas. Consumers perceive face wash to be replaceable with soap though the categories are distinct in terms of usage and benefits.

Face wash category– an Overview

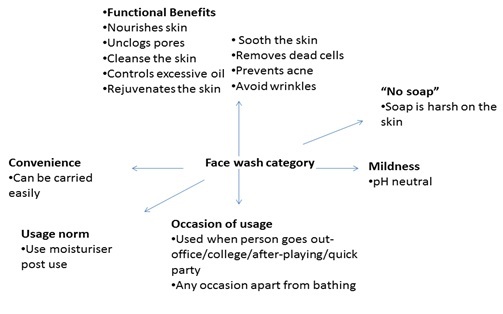

Face washes claim to give several benefits to consumers: skin nourishment, unclogging of pores, skin cleansing, controlling excessive oil, soothes the skin, prevents acne and pimples. People use face washes anytime of the day when they need to wash their face, i.e. any occasion apart from bathing. Since facial skin is thinner and softer, face washes are milder than soaps and are pH neutral. Although, skin experts say that after using a face wash, the norm is to use moistures to prevent dryness. Many face washes offered at present have the “no soap” promotion.

Exhibit1 Face wash category- an overview

Exhibit1 Face wash category- an overview

Soap category– an Overview

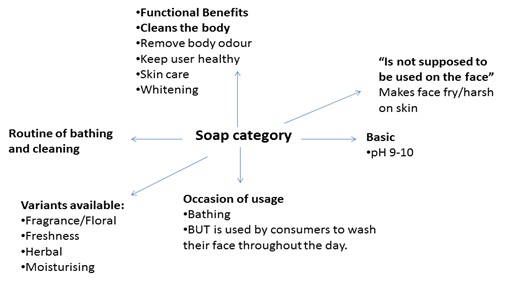

Soaps, although available in bar and liquid form, are primarily popular in the bar form, and contribute more than 88% to the bath and shower category. Variations in soaps are made based on presence of floral/fragrance, freshness, herbal, moisturizing ability or any other specific ingredients. Soaps are used for bathing and are associated with that ritual. However, because soaps are basic in nature (have higher pH), they are not supposed to be used on delicate facial skin. Soaps deliver the benefits of cleaning the body, removing body odour, skin care and whitening, in some cases.

Exhibit2 Soap category– an Overview

Exhibit2 Soap category– an Overview

Pears- the brand we chose

On studying the two categories, we found that whereas the two categories overlap in the fact that consumers use both for cleansing of the face, there are differences in terms of the occasion of use, price and the benefits that they talk of.

It was immediately evident from the analysis of the communication and brand imagery of each of the brands in face-wash and soap categories, that there are broadly two strategies followed by the brands in the market:

- Brands that have only face washes like Lakme, Garnier and Clean & Clear, focus on much differentiated benefits, clearly pitching themselves against other face washes in the category. We also saw that such brands offer many variants as a part of their portfolio- like many flavours, to cover the entire umbrella. These brands also emphasise on the disadvantages of soap on the skin in their communication.

- Brands that have soap and face- wash both in their umbrella; have communication that is in accord with the brand. They do not go all-out against the use of soap and focus on the brand’s proposition.

Pears face wash is an exception here.

Pears face wash, in its communication, talks about being very soft and tender on the skin. It shows the typical mother-daughter imagery with the mother as the user. They also mention that soap is harsh on the skin and women should not use it because it makes their skin dry. Pears face wash, it says, is as mild as water.

Pears face wash exhibits a unique contradiction in the strategy that the players follow in the market currently. Its target group (as analysed from the Value-Lifestyle framework) comprises conventional and traditional people with concrete beliefs who are family oriented and seek particular functional benefits. We also surmise that by having many variants in the face was umbrella and by attacking soaps in its own communication, it can cannibalise its own soap. Hence, Pears acts as a platform to highlight the points where face-wash and soaps overlap and differentiate.

Issues

When we come to deciding on sales promotion techniques for Pears face wash while targeting users of soap, we found the following issues as very relevant to the process:

- Which type of sales promotion technique should we use – price based, or non-price based?

- Does psychographics affect consumer’s response to promotions and to what extent?

- How does price affect perceived quality and perceived value?

- What is the influence of reference prices from a soap-user’s perspective when he is buying face wash?

Issue#1: Which type of sales promotion technique should we use – price based, or non-price based?

Price based promotions include discounts, rebates, coupons, etc. Non-price based promotions include contests, sweepstakes, patronage awards, cross promotions, etc.

Price based, as well as non-price based promotional techniques have their relative advantages and disadvantages. A careful analysis of the brand, product category, market, and context has to be undertaken before we can conclusively give our vote for one of them.

Whenever there is a chance of brand dilution, non-price based promotions are preferred against price-based promotions. In this case, Pears is already an established brand in soaps and stands for a clear positioning of tenderness and softness. When we analysed the advantages that non-price based promotion had (given hereunder), we realised that it could be the correct choice for a masstige distinct brand like Pears.

Advantages of non-price based promotion:

- Do not influence the internal reference price

- It provides the consumers with a Hedonic benefit. These benefits, such as entertainment and exploration, are similar to experiential emotions like pleasure and self-esteem.

- can help differentiate brands, communicating distinctive brand attributes and contribute to the improved brand equity

- might be able to induce loyal customers to try out new products, which price based promotions will not be able to do, since price is not a consideration at all for such category of consumers.

Disadvantages of using price based promotion

- Dilute the brand equity

- Affect brand associations, i.e. erode the associations. Also, these kinds of promotions are short term and fail to establish a long term association.

- Make the users think about the price, and not the product.

- Consumers generally use price as an extrinsic cue to infer product quality. They generally attribute a low level of quality with low or reduced prices

Issue#2: Do psychographics affect consumer’s response to promotions and to what extent?

We found that consumer behaviour literature was replete with theories to suggest that consumer psychographics play an important role in how they respond to deals and promotions.

Elaboration Likelihood Model: This theory suggests that response to promotional efforts differs depending upon the way promotional information is processed. Differences in effort and costs related to using different types of promotions, or differences in motivation for a purchase, may result in favouring one type of promotion over another.

Object Perception Theory: This theory confirmed that price based promotion may give the consumer the impression of inferior quality. For instance, if a “20% off offer is available on a hair oil” and hair oil is a highly competitive category, then consumers may perceive low price=low quality. However, this response depends on the consistency of promotion of the brand. Since Pears is masstige and does not involve in price based promotions, it was all the more relevant to use non price promotion for its face wash.

Prospect Theory: This theory enlightened us on how consumers perceive outcomes of a choice as 'losses' and 'gains' relative to a subjective reference point. Non-price promotions (e.g, premium offers, which segregate the promotional gain from the purchase price) are viewed as gains whereas price promotions (e.g, price off, which integrate the promotional gain with the purchase price) are viewed as reduced losses.

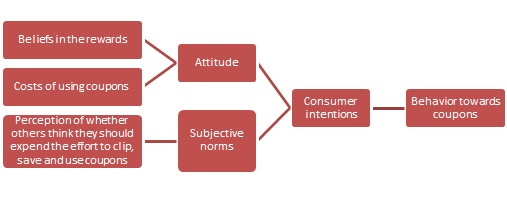

Theory of Reasoned Action Model:

Exhibit 3 Theory of reasoned action Model

Exhibit 3 Theory of reasoned action Model

While using coupons/discounts, psychological behaviour makes consumer aware of low price and it helps them create a reference point. It induces a feeling of being a "smart shopper" in the consumer as he feels he has cracked a great deal.

Issue#3: How does price affect perceived quality and perceived value?

There is significant variation in the price of face wash brands. Among the brands chosen, Ponds has the lowest price at Rs. 35 and Garnier Fresh has the highest price at Rs. 85. Pears is priced in the mid-lower end at Rs 45. This price level has an impact on the consumer perception about the brand because it creates a set of expectation in the consumer induced as a result of a combination of price, communication and usage. This in turn affects sales.

Decreasing the price during a sales promotion may affect consumer perception. Generally, a brand is diluted due to drop in price; however, this may not always be the case. In a product category like soaps and face washes, using price as a factor may lead to creating confusion in the minds of the current consumers in terms of the authenticity, grammage and quality of the product.

Issue#4: What is the influence of reference prices from a soap-user’s perspective when he is buying face wash?

When we intend to buy a face wash, the regular soap brand we use acts as an anchor to our internal reference price. We compare the prices and attributes of the soap with that of the face wash and refrain ourselves from buying the face-wash before fully understanding the benefits of the face wash. We access only readily available information before making a decision i.e. we use Selective accessibility for our purchase decision. The concept of cognitive loading i.e. educating and understanding the external cues before taking a purchase decision can avoid this price anchoring.

In retail stores, we usually notice that the face wash brands are always available near the soaps, which influence our purchase decision by price anchoring. Providing information and benefits in the aisle near face-wash display cases will help prevent this. In addition, the placement of face-wash should be near relatively costlier items such as Shampoos and body lotions, which will help modifying the price anchors from soaps to these costly items and influence purchase of face wash.

Recommendations

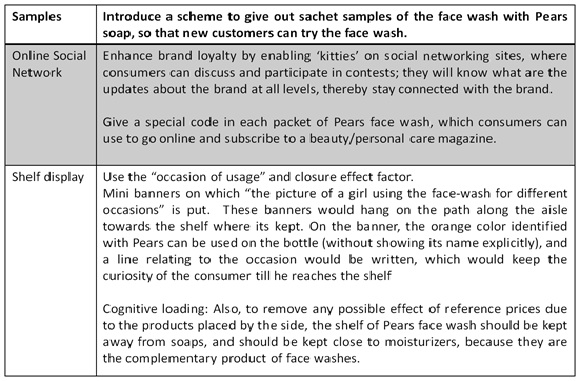

We propose the following steps to implement non-price based promotion for Pears face-wash:

Exhibit 4 Recommendations

Exhibit 4 Recommendations

Conclusion and Insights

How to avoid brand equity dilution?

This question is at the core of this article. We found that brand equity drivers include brand loyalty, perceived quality, brand image and the time for which it lasts with the price. Value conscious consumers, like that of Pears, are concerned about acquisition utility (the inherent need satisfying properties of the product). This focus implies that value conscious consumers are concerned about the products’ value over time, and they may have a longer and enduring involvement with it. Hence, taking into account the association of Pears with its consumers, sales promotion that would increase value for its users over time while not diluting its brand would be non-price based promotion.

Keywords

Perception, sales promotion, face-wash, soaps, Pears

Contributors

Abhik Saha (PGP 2011-13) holds a B.E. degree in Electronics & Tele-Communication from Jadavpur University, Kolkata and can be reached at

abhik.saha@iimb.ernet.in

Adeeba Ansari (PGP 2011-2013) holds a B.E degree in Electronics & Instrumentation from IET, DAVV, Indore and can be reached at

adeeba.ansari@iimb.ernet.in

Arvind Duray (PGP 2011-2013) holds a B.E degree in Electronics & Communication from R.V.C.E, Bangalore and can be reached at

arvind.duray@iimb.ernet.in

Ishan Gaikwad (PGP 2011-2013) holds a Dual Degree in Electrical Engineering from Indian Institute of Technology, Bombay and can be reached at

ishan.gaikwad@iimb.ernet.in

Jagaveera Ramkumar U. (PGP 2011-2013) holds a B.E. degree in Civil from PSG College of Technology, Coimbatore and can be reached at

jagaveera.ramkumar@iimb.ernet.in

Jayat Ghosh (PGP 2011-2013) holds a B.Tech degree in Mechanical Engineering from NIT, Silchar and can be reached at

jayat.ghosh@iimb.ernet.in

G. Krishna Kumar (PGP 2011-2013) holds a B.E degree in Production Engineering from PSG college of Technology, Coimbatore and can be reached at

krishna.kumar@iimb.ernet.in

Acknowledgment

The student contributors would like to thank Dr. S. Ramesh Kumar , Professor in the Marketing Department of Indian Institute of Management, Bangalore, for his guidance in their work. He can be reached at rkumar@iimb.ernet.in.

References

Articles from Journals

-

Dastidar, Surajit Ghosh and Datta, Biplab, 2008, ‘A Theoretical Analysis of the Critical Factors Governing Consumers' Deal Responsive Behavior’, South Asian Journal of Management, Vol 15, Issue 1, Jan-Mar, pp76-97, 22p.

-

Adaval, Rashmi and Wyer, Robert S, 2011, ‘Conscious and Nonconscious Comparisons with Price Anchors: Effects on Willingness to Pay for Related and Unrelated Products’, Journal of Marketing Research (JMR), Vol. 48, Issue 2, Apr, p355-365, 11p.

-

Valarie A. Zeithaml, 1988, ‘Consumer Perceptions of price, quality and Value: A means end model and synthesis of evidence’, Journal of Marketing, Vol 52, Jul, pp2-22.

-

Dennis A. Pitta and Lea Prevel Katsanis, 1995, ‘Understanding Brand equity for successful brand extension’, Journal of Consumer Marketing, Vol 12, No 4, Jul, p 51, 14p.

-

Daniel A. Sheinin, 2000 ‘The effects of experience with brand extensions on parent brand knowledge’, , Journal of Business Research, Vol. 49 No 1, Jul, p47-55, 9p.

-

Barry J. Babin, Laurie Babin, 2001, ‘Seeking something different? A model of schema typicality, consumer affect, purchase intentions and perceived shopping value’, Journal of Business Research; Vol. 54 No 2, Nov, p89-96, 8p.

-

Michel Larochea, Frank Ponsa, Nadia Zgollia, Marie-Ce´cile Cervellonb, Chankon Kimc, 2003, ‘A model of consumer response to two retail sales promotion techniques’, Journal of Business Research, Vol. 56 Issue 7, Jul, p513, 10p.

-

Eva Martínez Salinas, José Miguel Pina Pérez, 2009, ‘Modeling the brand extensions' influence on brand image’, Journal of Business Research, Vol. 62 Issue 1, Jan, p50-60, 11p.

-

Alan Dick, Arun Jain and Paul Richardson, 1996, ‘How consumers evaluate store brands’, Journal of Product & Brand Management, Vol. 5 Issue 2.

-

Devon Del Vecchio, David H. Henard , Traci H. Freling, 2006, ‘The effect of sales promotion on post-promotion brand preference: A meta-analysis’, Journal of Retailing, Vol. 82 Issue 3, Sep, p203-213, 11p.

-

Donald R. Lichtenstein, Scot Burton, Richard G. Netemeyer, 1997, ‘An Examination of Deal Proneness Across Sales Promotion Types: A Consumer Segmentation Perspective’, Journal of Retailing, Vol. 73 Issue 2, p283-297, 15p.

-

Kevin Lane Keller and Sanjay Sood, 2003, ‘Brand Equity Dilution’, MIT Sloan Management Review; Vol. 45 Issue 1, Sep, p12-15, 3p.

Books

-

Kotler, Keller, Keshy, Jha, 2009, Marketing Management: A South Asian Perspective, Pearson Publications, pp 221-222, 501-507.

-

Schiffman, Kanuk and Ramesh Kumar, 2010, Consumer Behaviour, Pearson Publications, pp 158–196.

Websites

-

Maps of India – Business, 2011, ‘Top Face Wash Brands in India’, June 20,

http://business.mapsofindia.com/top-brands-india/top-face-wash-brands-in-india.html,Last accessed on Feb 17, 2012.

-

Euromonitor International 2011, ‘Sector Capsule: Skin Care in India’ August 8,

http://www.portal.euromonitor.com/Portal/Pages/Search/SearchResultsList.aspx,Last accessed on Feb 1, 2012.

-

Unilever website,

http://www.hul.co.in,Last accessed on Feb 15, 2012.

-

Garnier website,

http://www.garnier.in,Last accessed on Feb 15, 2012.

-

Neutrogena website,

http://www.neutrogena.in,Last accessed on Feb 15, 2012.

-

For all company ads,

www.youtube.com,Last accessed on Feb 15, 2012.